Okay, here's an explanation of what the MetaTrader script does, without getting into programming jargon:

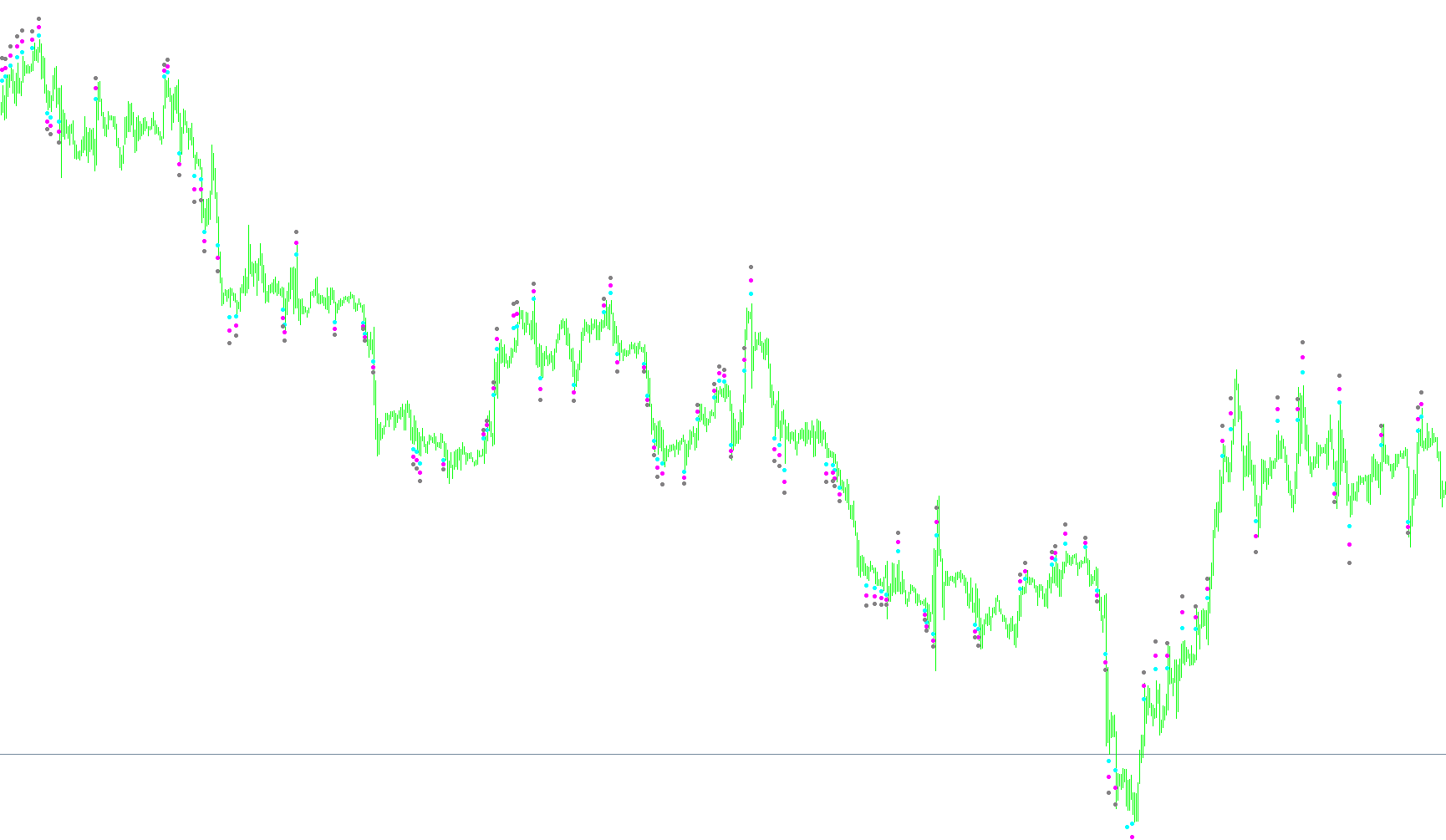

This script is designed to analyze price charts and identify potential entry points for trades based on a "channel breakout" strategy. It's inspired by the Turtle Trading rules. Here's the breakdown:

-

Defining Channels: The script first defines price channels based on recent highs and lows. It uses two different time periods (Range2 and Range3, for example, 20 and 55 time periods) to create two sets of channels. The channels are defined by the highest high and lowest low prices over those time periods. Think of these channels as representing the recent trading range.

-

ATR (Average True Range): The script uses the Average True Range (ATR) indicator to measure the volatility of the market. ATR tells you how much the price typically moves over a certain period (atr_range).

-

Breakout Identification: The script looks for moments when the price "breaks out" of these channels. A breakout happens when the price exceeds the upper boundary of the channel or falls below the lower boundary. When a breakout happens, that could indicate an opportunity to enter a trade.

-

Pyramiding Entry Points: The script calculates additional entry points that are based on the initial breakout level and the ATR. These entry points are spaced out using multiples of the ATR (add_atr_factor). These are used for entering multiple positions, or "pyramiding" into a trade, based on the trend. The idea is to add to a winning position if the price continues to move in the expected direction. These entry points are displayed as arrows on the chart.

-

Calculating ATR Based Risk: The script calculates how much risk the trader could assume based on the volatility by taking the ATR and multiplying it by a certain factor to estimate the value for a stop loss.

In essence, the script automatically draws channels on the price chart, identifies breakout points from these channels, and then suggests additional entry points based on the volatility of the market, as measured by the ATR. It uses these calculations to suggest to a trader a potential stop loss.

/*-----------------------------+

| |

| Shared by www.Aptrafx.com |

| |

+------------------------------*/

//+------------------------------------------------------------------+

//| channel_breakout_atr.mq4 |

//| with ATR Stop Loss calculation |

//| use this one for drawing 2nd, 3rd and 4th entry point |

//| as described in the turtle trading rules |

//+------------------------------------------------------------------+

#property copyright "darmasdt"

#property link "http://indotraders.org"

#property indicator_chart_window

#property indicator_buffers 8

#property indicator_color1 DarkGray

#property indicator_color2 DarkGray

#property indicator_color3 Blue

#property indicator_color4 Blue

#property indicator_color5 DarkOrange

#property indicator_color6 Green

#property indicator_color7 Plum

#property indicator_color8 Plum

//---- input parameters

//extern int Range1=10;

extern int Range2=20;

extern int Range3=55;

extern double atr_factor=2;

extern int atr_range=14;

extern double add_atr_factor=0.5;

extern double spread=5;

//---- buffers

double RISK_NxATR[];

double UpBuffer2[];

double DnBuffer2[];

double UpBuffer3[];

double DnBuffer3[];

double add_atr1[];

double add_atr2[];

double add_atr3[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

string short_name;

//---- indicator line

SetIndexStyle(0,DRAW_NONE,1);

SetIndexStyle(1,DRAW_NONE,1);

SetIndexStyle(2,DRAW_NONE,1);

SetIndexStyle(3,DRAW_NONE,1);

SetIndexStyle(4,DRAW_ARROW);

SetIndexArrow(4,159);

SetIndexStyle(5,DRAW_ARROW);

SetIndexArrow(5,159);

SetIndexStyle(6,DRAW_ARROW);

SetIndexArrow(6,159);

SetIndexStyle(7,DRAW_NONE,1);

SetIndexBuffer(0,UpBuffer2);

SetIndexLabel(0,"");

SetIndexBuffer(1,DnBuffer2);

SetIndexLabel(1,"");

SetIndexBuffer(2,UpBuffer3);

SetIndexLabel(2,"");

SetIndexBuffer(3,DnBuffer3);

SetIndexLabel(3,"");

SetIndexBuffer(4,add_atr1);

SetIndexLabel(4,"2nd pos");

SetIndexBuffer(5,add_atr2);

SetIndexLabel(5,"3rd pos");

SetIndexBuffer(6,add_atr3);

SetIndexLabel(6,"4th pos");

SetIndexBuffer(7,RISK_NxATR);

SetIndexLabel(7,"RISK_NxATR");

//---- name for DataWindow and indicator subwindow label

short_name="CBO_atr("+Range2+","+Range3+")";

IndicatorShortName(short_name);

//----

SetIndexDrawBegin(0,0);

SetIndexDrawBegin(1,0);

SetIndexDrawBegin(2,0);

SetIndexDrawBegin(3,0);

SetIndexDrawBegin(4,0);

SetIndexDrawBegin(5,0);

SetIndexDrawBegin(6,0);

SetIndexDrawBegin(7,0);

//----

return(0);

}

//+------------------------------------------------------------------+

//| Channel Trend System |

//+------------------------------------------------------------------+

int start()

{

int i;

//----

for(i=Bars-1;i>=0;i--)

{

//Calculating Channel

//-------------------

UpBuffer2[i]=High[Highest(NULL,0,MODE_HIGH,Range2,i+1)];

DnBuffer2[i]=Low[Lowest(NULL,0,MODE_LOW,Range2,i+1)];

UpBuffer3[i]=High[Highest(NULL,0,MODE_HIGH,Range3,i+1)];

DnBuffer3[i]=Low[Lowest(NULL,0,MODE_LOW,Range3,i+1)];

//Calculating ATR PYramiding

//---------------------

RISK_NxATR[i]=atr_factor*(iATR(NULL,0,atr_range,i+1))/Point;

if(High[i+1]<=UpBuffer2[i+1] && High[i]>UpBuffer2[i])

{

add_atr1[i]= UpBuffer2[i] + (iATR(NULL,0,atr_range,i+1)*add_atr_factor);

add_atr2[i]= UpBuffer2[i] + (iATR(NULL,0,atr_range,i+1)*add_atr_factor*2);

add_atr3[i]= UpBuffer2[i] + (iATR(NULL,0,atr_range,i+1)*add_atr_factor*3);

}

if(High[i+1]<=UpBuffer3[i+1] && High[i]>UpBuffer3[i])

{

add_atr1[i]= UpBuffer3[i] + (iATR(NULL,0,atr_range,i+1)*add_atr_factor);

add_atr2[i]= UpBuffer3[i] + (iATR(NULL,0,atr_range,i+1)*add_atr_factor*2);

add_atr3[i]= UpBuffer3[i] + (iATR(NULL,0,atr_range,i+1)*add_atr_factor*3);

}

if(Low[i+1]>=DnBuffer2[i+1] && Low[i]<DnBuffer2[i])

{

add_atr1[i]= DnBuffer2[i] - (iATR(NULL,0,atr_range,i+1)*add_atr_factor)+(spread*Point);

add_atr2[i]= DnBuffer2[i] - (iATR(NULL,0,atr_range,i+1)*add_atr_factor*2)+(spread*Point);

add_atr3[i]= DnBuffer2[i] - (iATR(NULL,0,atr_range,i+1)*add_atr_factor*3)+(spread*Point);

}

if(Low[i+1]>=DnBuffer3[i+1] && Low[i]<DnBuffer3[i])

{

add_atr1[i]= DnBuffer3[i] - (iATR(NULL,0,atr_range,i+1)*add_atr_factor)+(spread*Point);

add_atr2[i]= DnBuffer3[i] - (iATR(NULL,0,atr_range,i+1)*add_atr_factor*2)+(spread*Point);

add_atr3[i]= DnBuffer3[i] - (iATR(NULL,0,atr_range,i+1)*add_atr_factor*3)+(spread*Point);

}

}

return(0);

}

//+------------------------------------------------------------------+

Comments