This code snippet defines a custom indicator in MQL4. Let's break down what it does and how it's structured.

Overall Purpose:

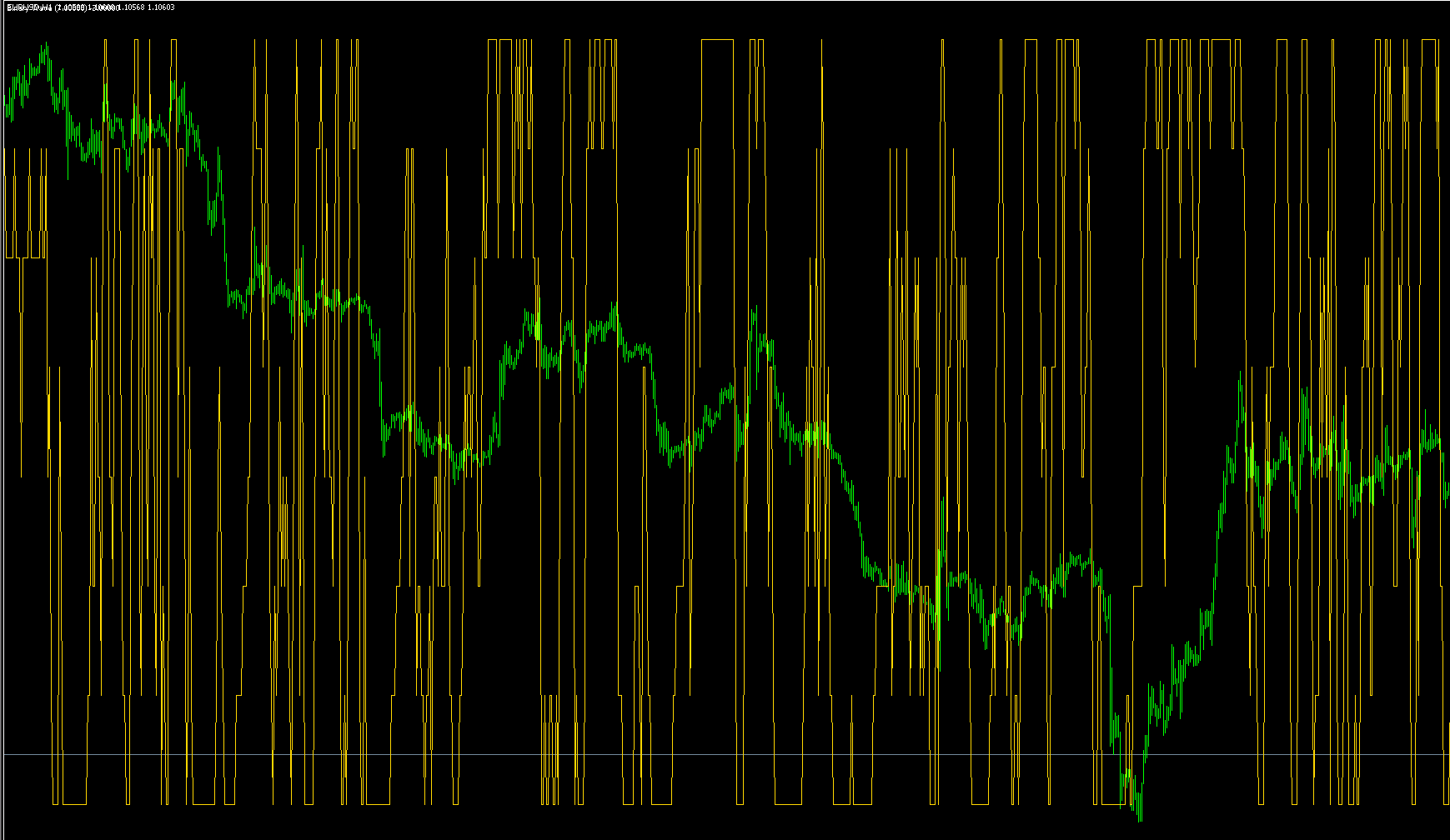

The indicator appears to be designed to combine several technical analysis indicators (Moving Average, MACD, Oscillator, CCI, Momentum, RSI, ADX) into a single "Wave" indicator. It calculates a combined value for each bar and then smooths this combined value using a moving average to create the final "Wave" signal.

Key Components and Explanation:

-

#property indicator_separate_windows true: This line indicates that the indicator will be displayed in a separate window. -

#property indicator_buffers 2: This declares that the indicator will use two buffers:WaveBufferandTempBuffer. -

#property indicator_plots 2: This declares that the indicator will have two plots. -

#property indicator_label1 "Wave": This sets the label for the first plot (WaveBuffer). -

#property indicator_color1 clrBlue: This sets the color of the first plot to blue. -

#property indicator_label2 "Combined Values": This sets the label for the second plot (TempBuffer). -

#property indicator_color2 clrRed: This sets the color of the second plot to red. -

#property indicator_buffers 2: Declares two buffers. -

#property indicator_plots 2: Declares two plots. -

#property indicator_label1 "Wave": Label for the WaveBuffer plot. -

#property indicator_color1 clrBlue: Color of the WaveBuffer plot. -

#property indicator_label2 "Combined Values": Label for the TempBuffer plot. -

#property indicator_color2 clrRed: Color of the TempBuffer plot. -

start()Function: This is the main function that calculates the indicator values.

IndicatorCounted()andBars: These variables are used to determine the number of bars that have already been processed and the total number of bars in the chart.limit = Bars - counted_bars;: Calculates the number of bars to process.TempBuffer[i] = MAClose(i) + MACD(i) + OsMA(i) + CCI(i) + MOM(i) + RSI(i) + ADX(i);: This is the core calculation. It sums the results of seven different indicator functions for each bar. TheMAClose,MACD,OsMA,CCI,MOM,RSI, andADXfunctions are defined later in the code.iMAOnArray(TempBuffer, 0, MovWavePer, 0, MovWaveType, i);: This applies a moving average to theTempBuffervalues to smooth the combined indicator.MovWavePeris the period of the moving average, andMovWaveTypespecifies the type of moving average (e.g., Simple, Exponential, Smoothed).WaveBuffer[i] = TempBuffer[i];: IfMovWavePeris 1, theWaveBufferis simply equal to theTempBuffer.

- Indicator Functions (MAClose, MACD, OsMA, CCI, MOM, RSI, ADX):

- These functions calculate the values of the individual indicators. They are defined later in the code. Each function takes a bar index

ias input and returns a value. MAClose(i): Calculates a moving average of the closing prices.MACD(i): Calculates the MACD (Moving Average Convergence Divergence).OsMA(i): Calculates the Oscillator.CCI(i): Calculates the Commodity Channel Index.MOM(i): Calculates the Momentum.RSI(i): Calculates the Relative Strength Index.ADX(i): Calculates the Average Directional Index.

Key Observations and Potential Improvements:

- Indicator Function Definitions: The code snippet only shows the

start()function. The definitions of the individual indicator functions (MAClose, MACD, OsMA, CCI, MOM, RSI, ADX) are missing. These are crucial for the indicator to work correctly. - Parameterization: The indicator has several parameters (e.g., periods for moving averages, RSI, ADX). These parameters are likely defined as external input parameters, allowing the user to customize the indicator's behavior.

- Weighting: The code simply sums the values of the individual indicators. It might be beneficial to assign different weights to each indicator based on their relative importance or expected contribution to the overall signal.

- Normalization: The individual indicators might have different scales. Normalizing the values before summing them could improve the accuracy and stability of the combined indicator.

- Error Handling: The code doesn't include any error handling. It's important to add checks to ensure that the input parameters are valid and that the indicator functions don't produce errors.

In summary, this code defines a custom indicator that combines several technical analysis indicators into a single "Wave" signal. The indicator calculates a combined value for each bar and then smooths this combined value using a moving average. The code is incomplete, as the definitions of the individual indicator functions are missing. However, the overall structure and logic of the indicator are clear.

//+------------------------------------------------------------------+

//| BinaryWave.mq4 |

//| Copyright © 2009, LeMan |

//| b-market@mail.ru |

//+------------------------------------------------------------------+

#property copyright "Copyright © 2009, LeMan"

#property link "b-market@mail.ru"

#property indicator_separate_window

#property indicator_buffers 1

#property indicator_color1 Blue

//--- Âåñ èíäèêàòîðîâ. Åñëè íîëü, èíäèêàòîð íå ó÷àñòâóåò â ðàñ÷åòå âîëíû

extern double WeightMA = 1.0;

extern double WeightMACD = 1.0;

extern double WeightOsMA = 1.0;

extern double WeightCCI = 1.0;

extern double WeightMOM = 1.0;

extern double WeightRSI = 1.0;

extern double WeightADX = 1.0;

//---- Ïàðàìåòðû ñêîëüçÿùåãî ñðåäíåãî

extern int MAPeriod = 13;

extern int MAType = 1;

extern int MAPrice = 0;

//---- Ïàðàìåòðû OsMA

extern int FastMACD = 12;

extern int SlowMACD = 26;

extern int SignalMACD = 9;

extern int PriceMACD = 0;

//---- Ïàðàìåòðû OsMA

extern int FastPeriod = 12;

extern int SlowPeriod = 26;

extern int SignalPeriod = 9;

extern int OsMAPrice = 0;

//---- Ïàðàìåòðû CCI

extern int CCIPeriod = 14;

extern int CCIPrice = 5;

//---- Ïàðàìåòðû Ìîìåíòà

extern int MOMPeriod = 14;

extern int MOMPrice = 0;

//---- Ïàðàìåòðû RSI

extern int RSIPeriod = 14;

extern int RSIPrice = 0;

//---- Ïàðàìåòðû ADX

extern int ADXPeriod = 14;

extern int ADXPrice = 0;

//---- Âêëþ÷åíèå ñãëàæèâàíèÿ âîëíû

extern int MovWavePer = 1;

extern int MovWaveType = 0;

//---- buffers

double WaveBuffer[];

double TempBuffer[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

IndicatorDigits(Digits);

IndicatorBuffers(2);

double ws = WeightMA+WeightMACD+WeightOsMA+WeightCCI+WeightMOM+WeightRSI+WeightADX;

string short_name = "Binary Wave ("+DoubleToStr(ws,Digits)+")";

//---- indicators

IndicatorShortName(short_name);

SetIndexBuffer(0,WaveBuffer);

SetIndexBuffer(1,TempBuffer);

SetIndexStyle(0,DRAW_LINE);

//----

return(0);

}

//---- Îïðåäåëÿåì ïîëîæåíèå öåíû çàêðûòèÿ îòíîñèòåëüíî ñêîëüçÿùåãî ñðåäíåãî

double MAClose(int i = 0) {

if (WeightMA > 0) {

if ((Close[i]-iMA(NULL,0,MAPeriod,0,MAType,MAPrice,i)) > 0)

return(WeightMA);

if ((Close[i]-iMA(NULL,0,MAPeriod,0,MAType,MAPrice,i)) < 0)

return(-WeightMA);

if ((Close[i]-iMA(NULL,0,MAPeriod,0,MAType,MAPrice,i)) == 0)

return(0);

} else {

return(0);

}

}

//---- Îïðåäåëÿåì íàêëîí MACD

double MACD(int i = 0) {

if (WeightMACD > 0) {

if (iMACD(NULL,0,FastMACD,SlowMACD,SignalMACD,PriceMACD,MODE_MAIN,i)-iMACD(NULL,0,FastMACD,SlowMACD,SignalMACD,PriceMACD,MODE_MAIN,i+1) > 0)

return(WeightMACD);

if (iMACD(NULL,0,FastMACD,SlowMACD,SignalMACD,PriceMACD,MODE_MAIN,i)-iMACD(NULL,0,FastMACD,SlowMACD,SignalMACD,PriceMACD,MODE_MAIN,i+1) < 0)

return(-WeightMACD);

if (iMACD(NULL,0,FastMACD,SlowMACD,SignalMACD,PriceMACD,MODE_MAIN,i)-iMACD(NULL,0,FastMACD,SlowMACD,SignalMACD,PriceMACD,MODE_MAIN,i+1) == 0)

return(0);

} else {

return(0);

}

}

//---- Îïðåäåëÿåì ïîëîæåíèå OsMa îòíîñèòåëüíî íóëÿ

double OsMA(int i = 0) {

if (WeightOsMA > 0) {

if (iOsMA(NULL,0,FastPeriod,SlowPeriod,SignalPeriod,OsMAPrice,i) > 0)

return(WeightOsMA);

if (iOsMA(NULL,0,FastPeriod,SlowPeriod,SignalPeriod,OsMAPrice,i) < 0)

return(-WeightOsMA);

if (iOsMA(NULL,0,FastPeriod,SlowPeriod,SignalPeriod,OsMAPrice,i) == 0)

return(0);

} else {

return(0);

}

}

//---- Îïðåäåëÿåì ïîëîæåíèå CCI îòíîñèòåëüíî íóëÿ

double CCI(int i = 0) {

if (WeightCCI > 0) {

if (iCCI(NULL,0,CCIPeriod,CCIPrice,i) > 0)

return(WeightCCI);

if (iCCI(NULL,0,CCIPeriod,CCIPrice,i) < 0)

return(-WeightCCI);

if (iCCI(NULL,0,CCIPeriod,CCIPrice,i) == 0)

return(0);

} else {

return(0);

}

}

//---- Îïðåäåëÿåì ïîëîæåíèå Momentum îòíîñèòåëüíî 100

double MOM(int i = 0) {

if (WeightMOM > 0) {

if (iMomentum(NULL,0,MOMPeriod,MOMPrice,i) > 100)

return(WeightMOM);

if (iMomentum(NULL,0,MOMPeriod,MOMPrice,i) < 100)

return(-WeightMOM);

if (iMomentum(NULL,0,MOMPeriod,MOMPrice,i) == 100)

return(0);

} else {

return(0);

}

}

//---- Îïðåäåëÿåì ïîëîæåíèå RSI îòíîñèòåëüíî 50

double RSI(int i = 0) {

if (WeightRSI > 0) {

if (iRSI(NULL,0,RSIPeriod,RSIPrice,i) > 50)

return(WeightRSI);

if (iRSI(NULL,0,RSIPeriod,RSIPrice,i) < 50)

return(-WeightRSI);

if (iRSI(NULL,0,RSIPeriod,RSIPrice,i) == 50)

return(0);

} else {

return(0);

}

}

//---- Îïðåäåëÿåì ïîëîæåíèå DMI

double ADX(int i = 0) {

if (WeightADX > 0) {

if (iADX(NULL,0,ADXPeriod,ADXPrice,MODE_PLUSDI,i) > iADX(NULL,0,ADXPeriod,RSIPrice,MODE_MINUSDI,i))

return(WeightADX);

if (iADX(NULL,0,ADXPeriod,ADXPrice,MODE_PLUSDI,i) < iADX(NULL,0,ADXPeriod,RSIPrice,MODE_MINUSDI,i))

return(-WeightADX);

if (iADX(NULL,0,ADXPeriod,ADXPrice,MODE_PLUSDI,i) == iADX(NULL,0,ADXPeriod,RSIPrice,MODE_MINUSDI,i))

return(0);

} else {

return(0);

}

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

int i, limit, counted_bars=IndicatorCounted();

//----

if (counted_bars > 0) counted_bars--;

limit = Bars-counted_bars;

//---- macd

for (i = 0; i < limit; i++)

TempBuffer[i] = MAClose(i)+MACD(i)+OsMA(i)+CCI(i)+MOM(i)+RSI(i)+ADX(i);

//----

int max = MathMax(MAPeriod,MathMax(SlowPeriod,MathMax(CCIPeriod,MathMax(SlowMACD,MOMPeriod))));

//----

if (Bars <= max) return(0);

//---- initial zero

if (counted_bars < 1)

for (i = 1; i <= max; i++) WaveBuffer[Bars-i] = 0.0;

//----

i = Bars-max-1;

if (counted_bars >= max) i = Bars-counted_bars-1;

while(i >= 0) {

if (MovWavePer > 1) {

WaveBuffer[i] = iMAOnArray(TempBuffer,0,MovWavePer,0,MovWaveType,i);

} else {

WaveBuffer[i] = TempBuffer[i];

}

i--;

}

return(0);

}

//+------------------------------------------------------------------+

Comments