//+------------------------------------------------------------------+

//| |

//| Copyright © 1999-2008, MetaQuotes Software Corp. |

//| http://www.metaquotes.ru |

//+------------------------------------------------------------------+

//+--------------------------------------------------------------------+

//| TII_RLH |

//| Copyright © 2006, Robert Hill |

//| http://www.metaquotes.net/ |

//| |

//| Based on the formula developed by M. H. PEE |

//| |

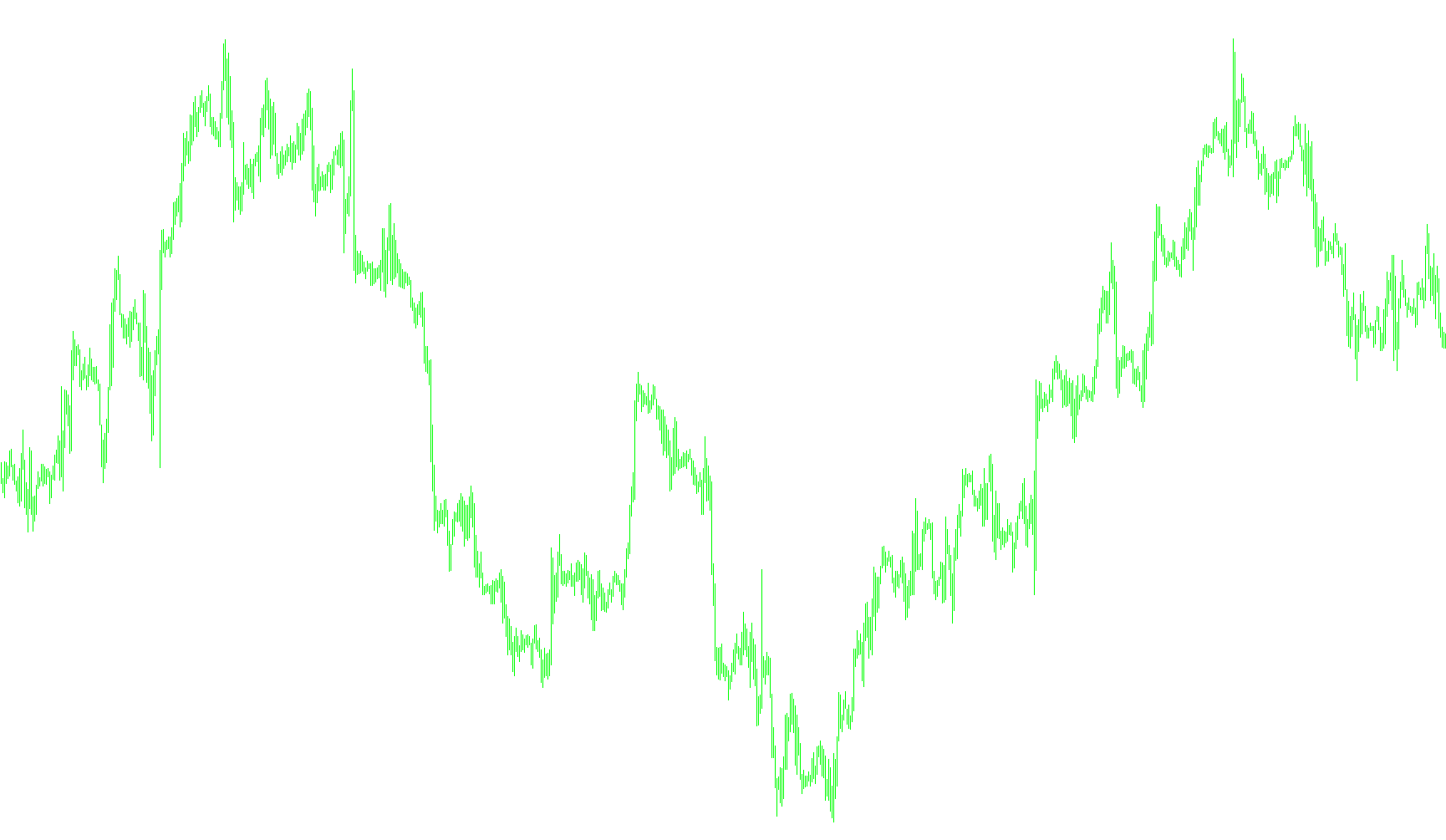

//| Trend Intensity Index. |

//| |

//| TII is used to indicate the strength of the current trend in the |

//| market. The stronger the current trend, the more likely the |

//| market will continue moving in the current direction. |

//| It is recommended to enter the market during a strong trend |

//| and ride it until TII shows signs of a reversal, at which time |

//| you should abandon your position and prepare to enter in the |

//| opposite direction. |

//| Pee recommends using a major period of 60 and a minor period of 30.|

//| Assuming these setting, TII is calculated as follows. |

//| The 60 bar simple moving average (MA) is computed. |

//| The deviation between the closing price and this computed average |

//| for each of the last 30 bars is computed (CL - MA). |

//| Positive deviations (CL > MA) are summed to give SDPOS. |

//| Negative deviations (CL < MA) are summed to give SDNEG. |

//| Then, the 30 period TII is calculated as: |

//| 100 * SDPOS / (SDPOS - SDNEG). |

//| TII ranges from a lower limit of 0 to an upper limit of 100 |

//| A TII value above 50 signals an uptrend |

//| A TII value of 80 means that 80% of the total deviations are up |

//| When TII fall below 50, a downtrend is likely in place |

//| 50 represents a level that is trend-neutral |

//| The closer TII is to 100, the stronger the current uptrend |

//| The closer TII is to 0, the stronger the current downtrend |

//| |

//+--------------------------------------------------------------------+

#property copyright "Copyright © 2006, Robert Hill "

#property link "http://www.metaquotes.net/"

//---- indicator settings

#property indicator_separate_window

#property indicator_buffers 1

#property indicator_color1 Red

#property indicator_width1 2

//----

extern int Major_Period=60;

extern int Major_MaMode=1; //0=sma, 1=ema, 2=smma, 3=lwma, 4=lsma

extern int Major_PriceMode=0;//0=close, 1=open, 2=high, 3=low, 4=median(high+low)/2, 5=typical(high+low+close)/3, 6=weighted(high+low+close+close)/4

extern int Minor_Period=30;

extern color LevelColor=Silver;

extern int BuyLevel=20;

extern int MidLevel=50;

extern int SellLevel=80;

//---- buffers

double ma[];

double ma_dev[];

double tii[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

//---- drawing settings

IndicatorBuffers(3);

SetIndexStyle(0,DRAW_LINE);

SetIndexDrawBegin(0,Major_Period);

IndicatorDigits(MarketInfo(Symbol(),MODE_DIGITS)+2);

//---- 3 indicator buffers mapping

if(!SetIndexBuffer(0,tii) &&

!SetIndexBuffer(1,ma_dev) &&

!SetIndexBuffer(2,ma))

Print("cannot set indicator buffers!");

//---- name for DataWindow and indicator subwindow label

IndicatorShortName(" TII , Major_Period ( "+Major_Period+" ) , Minor_Period ( "+Minor_Period+" ), ");

SetLevelStyle(STYLE_DASH,1,LevelColor);

SetLevelValue(0,BuyLevel);

SetLevelValue(1,MidLevel);

SetLevelValue(2,SellLevel);

//---- initialization done

return(0);

}

//+------------------------------------------------------------------+

//| LSMA with PriceMode |

//| PrMode 0=close, 1=open, 2=high, 3=low, 4=median(high+low)/2, |

//| 5=typical(high+low+close)/3, 6=weighted(high+low+close+close)/4 |

//+------------------------------------------------------------------+

double LSMA(int Rperiod, int prMode, int shift)

{

int i;

double sum, pr;

int length;

double lengthvar;

double tmp;

double wt;

//----

length=Rperiod;

sum=0;

for(i=length; i>=1 ;i--)

{

lengthvar=length + 1;

lengthvar/=3;

tmp=0;

switch(prMode)

{

case 0: pr=Close[length-i+shift];break;

case 1: pr=Open[length-i+shift];break;

case 2: pr=High[length-i+shift];break;

case 3: pr=Low[length-i+shift];break;

case 4: pr=(High[length-i+shift] + Low[length-i+shift])/2;break;

case 5: pr=(High[length-i+shift] + Low[length-i+shift] + Close[length-i+shift])/3;break;

case 6: pr=(High[length-i+shift] + Low[length-i+shift] + Close[length-i+shift] + Close[length-i+shift])/4;break;

}

tmp =(i - lengthvar)*pr;

sum+=tmp;

}

wt=sum*6/(length*(length+1));

//----

return(wt);

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

int start()

{

int i,j, limit;

double sdPos, sdNeg;

int counted_bars=IndicatorCounted();

if(counted_bars>0) counted_bars--;

limit=Bars-counted_bars;

//----

for(i=limit; i>=0; i--)

{

if (Major_MaMode==4)

{

ma[i]=LSMA(Major_Period, Major_PriceMode, i);

}

else

{

ma[i]=iMA(NULL,0,Major_Period,0,Major_MaMode,Major_PriceMode,i);

}

ma_dev[i]=Close[i] - ma[i];

}

//========== COLOR CODING ===========================================

for(i=0; i <=limit; i++)

{

sdPos=0;

sdNeg=0;

for(j=i;j<i+Minor_Period;j++)

{

if (ma_dev[j]>=0) sdPos=sdPos + ma_dev[j];

if (ma_dev[j] < 0) sdNeg=sdNeg + ma_dev[j];

}

tii[i]=100 * sdPos/(sdPos - sdNeg);

}

//----

return(0);

}

//+------------------------------------------------------------------+

Comments