//+------------------------------------------------------------------+

//| MMLevls_VG.mq4 |

//| Copyright © 2006, Vladislav Goshkov (VG). |

//| 4vg@mail.ru |

//| Many thanks to Tim Kruzel |

//+------------------------------------------------------------------+

#property copyright "Vladislav Goshkov (VG)."

#property link "4vg@mail.ru"

//----

#property indicator_chart_window

// ============================================================================================

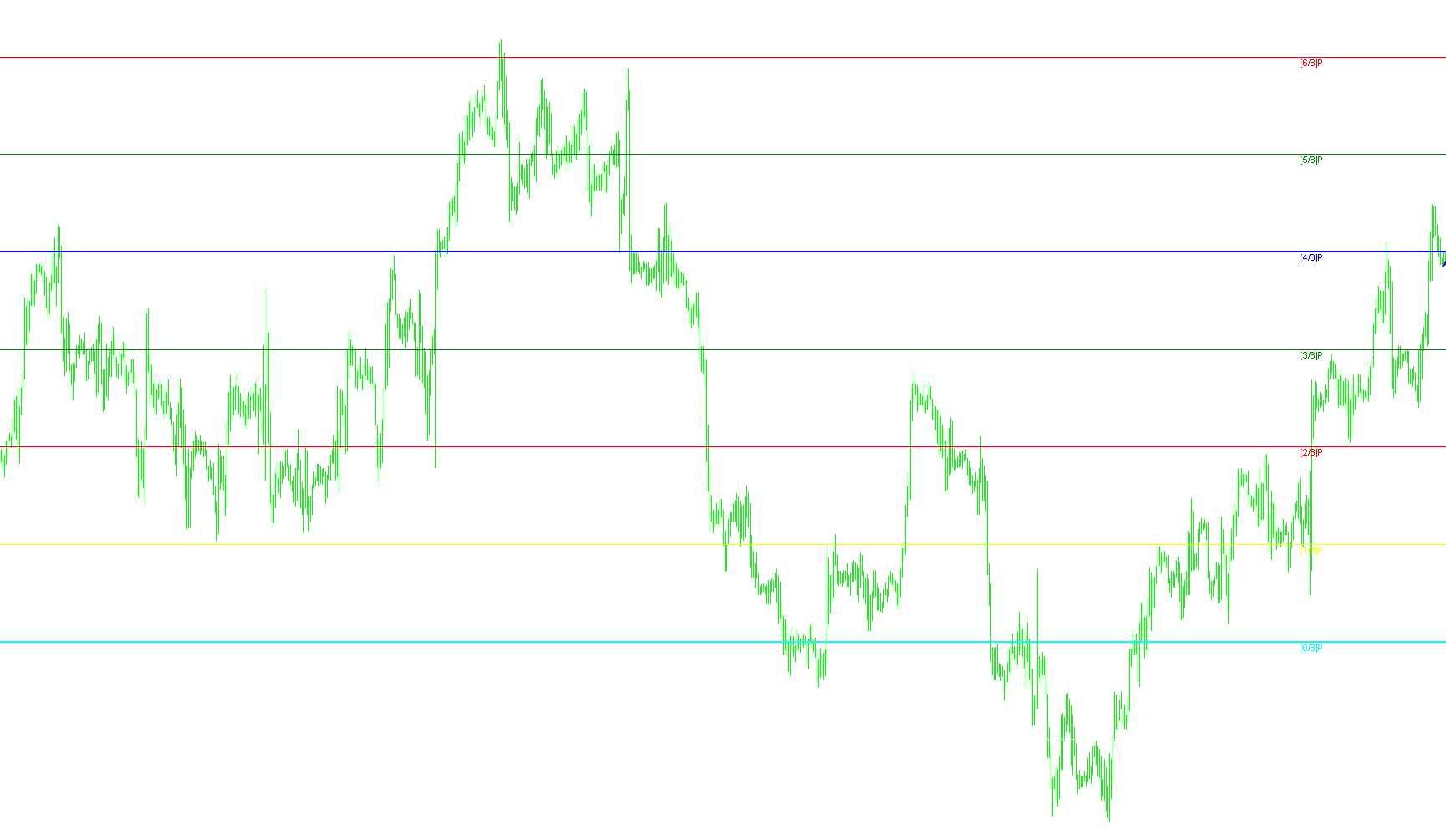

// * Ëèíèè 8/8 è 0/8 (Îêîí÷àòåëüíîå ñîïðîòèâëåíèå).

// * Ýòè ëèíèè ñàìûå ñèëüíûå è îêàçûâàþò ñèëüíåéøèå ñîïðîòèâëåíèÿ è ïîääåðæêó.

// ============================================================================================

//* Ëèíèÿ 7/8 (Ñëàáàÿ, ìåñòî äëÿ îñòàíîâêè è ðàçâîðîòà). Weak, Stall and Reverse

//* Ýòà ëèíèÿ ñëàáà. Åñëè öåíà çàøëà ñëèøêîì äàëåêî è ñëèøêîì áûñòðî è åñëè îíà îñòàíîâèëàñü îêîëî ýòîé ëèíèè,

//* çíà÷èò îíà ðàçâåðíåòñÿ áûñòðî âíèç. Åñëè öåíà íå îñòàíîâèëàñü îêîëî ýòîé ëèíèè, îíà ïðîäîëæèò äâèæåíèå ââåðõ ê 8/8.

// ============================================================================================

//* Ëèíèÿ 1/8 (Ñëàáàÿ, ìåñòî äëÿ îñòàíîâêè è ðàçâîðîòà). Weak, Stall and Reverse

//* Ýòà ëèíèÿ ñëàáà. Åñëè öåíà çàøëà ñëèøêîì äàëåêî è ñëèøêîì áûñòðî è åñëè îíà îñòàíîâèëàñü îêîëî ýòîé ëèíèè,

//* çíà÷èò îíà ðàçâåðíåòñÿ áûñòðî ââåðõ. Åñëè öåíà íå îñòàíîâèëàñü îêîëî ýòîé ëèíèè, îíà ïðîäîëæèò äâèæåíèå âíèç ê 0/8.

// ============================================================================================

//* Ëèíèè 6/8 è 2/8 (Âðàùåíèå, ðàçâîðîò). Pivot, Reverse

//* Ýòè äâå ëèíèè óñòóïàþò â ñâîåé ñèëå òîëüêî 4/8 â ñâîåé ñïîñîáíîñòè ïîëíîñòüþ ðàçâåðíóòü öåíîâîå äâèæåíèå.

// ============================================================================================

//* Ëèíèÿ 5/8 (Âåðõ òîðãîâîãî äèàïàçîíà). Top of Trading Range

//* Öåíû âñåõ ðûíêîâ òðàòÿò 40% âðåìåíè, íà äâèæåíèå ìåæäó 5/8 è 3/8 ëèíèÿìè.

//* Åñëè öåíà äâèãàåòñÿ îêîëî ëèíèè 5/8 è îñòàåòñÿ îêîëî íåå â òå÷åíèè 10-12 äíåé, ðûíîê ñêàçàë ÷òî ñëåäóåò

//* ïðîäàâàòü â ýòîé «ïðåìèàëüíîé çîíå», ÷òî è äåëàþò íåêîòîðûå ëþäè, íî åñëè öåíà ñîõðàíÿåò òåíäåíöèþ îñòàâàòüñÿ

//* âûøå 5/8, òî îíà è îñòàíåòñÿ âûøå íåå. Åñëè, îäíàêî, öåíà ïàäàåò íèæå 5/8, òî îíà ñêîðåå âñåãî ïðîäîëæèò

//* ïàäàòü äàëåå äî ñëåäóþùåãî óðîâíÿ ñîïðîòèâëåíèÿ.

// ============================================================================================

//* Ëèíèÿ 3/8 (Äíî òîðãîâîãî äèàïàçîíà). Bottom of Trading Range

//* Åñëè öåíû íèæå ýòîé ëèíè è äâèãàþòñÿ ââåðõ, òî öåíå áóäåò ñëîæíî ïðîáèòü ýòîò óðîâåíü.

//* Åñëè ïðîáèâàþò ââåðõ ýòó ëèíèþ è îñòàþòñÿ âûøå íåå â òå÷åíèè 10-12 äíåé, çíà÷èò öåíû îñòàíóòñÿ âûøå ýòîé ëèíèè

//* è ïîòðàòÿò 40% âðåìåíè äâèãàÿñü ìåæäó ýòîé ëèíèåé è 5/8 ëèíèåé.

// ============================================================================================

//* Ëèíèÿ 4/8 (Ãëàâíàÿ ëèíèÿ ñîïðîòèâëåíèÿ/ïîääåðæêè). Major Support/Resistance

//* Ýòà ëèíèÿ îáåñïå÷èâàåò íàèáîëüøåå ñîïðîòèâëåíèå/ïîääåðæêó. Ýòîò óðîâåíü ÿâëÿåòñÿ ëó÷øèì äëÿ íîâîé ïîêóïêè èëè ïðîäàæè.

//* Åñëè öåíà íàõîäèòñÿ âûøå 4/8, òî ýòî ñèëüíûé óðîâåíü ïîääåðæêè. Åñëè öåíà íàõîäèòñÿ íèæå 4/8, òî ýòî ïðåêðàñíûé óðîâåíü

//* ñîïðîòèâëåíèÿ.

// ============================================================================================

extern int P=90;

extern int MMPeriod=1440;

extern int StepBack=0;

//----

extern color mml_clr_m_2_8=White; // [-2]/8

extern color mml_clr_m_1_8=White; // [-1]/8

extern color mml_clr_0_8 =Aqua; // [0]/8

extern color mml_clr_1_8 =Yellow; // [1]/8

extern color mml_clr_2_8 =Red; // [2]/8

extern color mml_clr_3_8 =Green; // [3]/8

extern color mml_clr_4_8 =Blue; // [4]/8

extern color mml_clr_5_8 =Green; // [5]/8

extern color mml_clr_6_8 =Red; // [6]/8

extern color mml_clr_7_8 =Yellow; // [7]/8

extern color mml_clr_8_8 =Aqua; // [8]/8

extern color mml_clr_p_1_8=White; // [+1]/8

extern color mml_clr_p_2_8=White; // [+2]/8

extern int mml_wdth_m_2_8=2; // [-2]/8

extern int mml_wdth_m_1_8=1; // [-1]/8

extern int mml_wdth_0_8 =2; // [0]/8

extern int mml_wdth_1_8 =1; // [1]/8

extern int mml_wdth_2_8 =1; // [2]/8

extern int mml_wdth_3_8 =1; // [3]/8

extern int mml_wdth_4_8 =2; // [4]/8

extern int mml_wdth_5_8 =1; // [5]/8

extern int mml_wdth_6_8 =1; // [6]/8

extern int mml_wdth_7_8 =1; // [7]/8

extern int mml_wdth_8_8 =2; // [8]/8

extern int mml_wdth_p_1_8=1; // [+1]/8

extern int mml_wdth_p_2_8=2; // [+2]/8

extern color MarkColor =Blue;

extern int MarkNumber =217;

//----

double dmml=0,

dvtl=0,

sum =0,

v1=0,

v2=0,

mn=0,

mx=0,

x1=0,

x2=0,

x3=0,

x4=0,

x5=0,

x6=0,

y1=0,

y2=0,

y3=0,

y4=0,

y5=0,

y6=0,

octave=0,

fractal=0,

range =0,

finalH =0,

finalL =0,

mml[13];

string ln_txt[13],

buff_str="";

int

bn_v1 =0,

bn_v2 =0,

OctLinesCnt=13,

mml_thk=8,

mml_clr[13],

mml_wdth[13],

mml_shft=35,

nTime=0,

CurPeriod=0,

nDigits=0,

i=0;

int NewPeriod=0;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

//---- indicators

if(MMPeriod>0)

NewPeriod =P*MathCeil(MMPeriod/Period());

else NewPeriod=P;

//----

ln_txt[0] ="[-2/8]P";// "extremely overshoot [-2/8]";// [-2/8]

ln_txt[1] ="[-1/8]P";// "overshoot [-1/8]";// [-1/8]

ln_txt[2] ="[0/8]P";// "Ultimate Support - extremely oversold [0/8]";// [0/8]

ln_txt[3] ="[1/8]P";// "Weak, Stall and Reverse - [1/8]";// [1/8]

ln_txt[4] ="[2/8]P";// "Pivot, Reverse - major [2/8]";// [2/8]

ln_txt[5] ="[3/8]P";// "Bottom of Trading Range - [3/8], if 10-12 bars then 40% Time. BUY Premium Zone";//[3/8]

ln_txt[6] ="[4/8]P";// "Major Support/Resistance Pivotal Point [4/8]- Best New BUY or SELL level";// [4/8]

ln_txt[7] ="[5/8]P";// "Top of Trading Range - [5/8], if 10-12 bars then 40% Time. SELL Premium Zone";//[5/8]

ln_txt[8] ="[6/8]P";// "Pivot, Reverse - major [6/8]";// [6/8]

ln_txt[9] ="[7/8]P";// "Weak, Stall and Reverse - [7/8]";// [7/8]

ln_txt[10]="[8/8]P";// "Ultimate Resistance - extremely overbought [8/8]";// [8/8]

ln_txt[11]="[+1/8]P";// "overshoot [+1/8]";// [+1/8]

ln_txt[12]="[+2/8]P";// "extremely overshoot [+2/8]";// [+2/8]

//mml_shft = 3;

mml_thk =3;

// Íà÷àëüíàÿ óñòàíîâêà öâåòîâ óðîâíåé îêòàâ è òîëùèíû ëèíèé

mml_clr[0] =mml_clr_m_2_8; mml_wdth[0]=mml_wdth_m_2_8; // [-2]/8

mml_clr[1] =mml_clr_m_1_8; mml_wdth[1]=mml_wdth_m_1_8; // [-1]/8

mml_clr[2] =mml_clr_0_8; mml_wdth[2]=mml_wdth_0_8; // [0]/8

mml_clr[3] =mml_clr_1_8; mml_wdth[3]=mml_wdth_1_8; // [1]/8

mml_clr[4] =mml_clr_2_8; mml_wdth[4]=mml_wdth_2_8; // [2]/8

mml_clr[5] =mml_clr_3_8; mml_wdth[5]=mml_wdth_3_8; // [3]/8

mml_clr[6] =mml_clr_4_8; mml_wdth[6]=mml_wdth_4_8; // [4]/8

mml_clr[7] =mml_clr_5_8; mml_wdth[7]=mml_wdth_5_8; // [5]/8

mml_clr[8] =mml_clr_6_8; mml_wdth[8]=mml_wdth_6_8; // [6]/8

mml_clr[9] =mml_clr_7_8; mml_wdth[9]=mml_wdth_7_8; // [7]/8

mml_clr[10]=mml_clr_8_8; mml_wdth[10]= mml_wdth_8_8; // [8]/8

mml_clr[11]=mml_clr_p_1_8; mml_wdth[11]= mml_wdth_p_1_8; // [+1]/8

mml_clr[12]=mml_clr_p_2_8; mml_wdth[12]= mml_wdth_p_2_8; // [+2]/8

//----

return(0);

}

//+------------------------------------------------------------------+

//| Custor indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

//---- TODO: add your code here

Comment(" ");

for(i=0;i<OctLinesCnt;i++)

{

buff_str="mml"+i;

ObjectDelete(buff_str);

buff_str="mml_txt"+i;

ObjectDelete(buff_str);

}

//----

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

//---- TODO: add your code here

if((nTime!=Time[0]) || (CurPeriod!=Period())){

//price

Print("MMLevls : NewPeriod = ",NewPeriod);

bn_v1=Lowest(NULL,0,MODE_LOW,NewPeriod,StepBack);

bn_v2=Highest(NULL,0,MODE_HIGH,NewPeriod,StepBack);

v1=Low[bn_v1];

v2=High[bn_v2];

//determine fractal.....

if(v2<=250000 && v2>25000 )

fractal=100000;

else

if(v2<=25000 && v2>2500 )

fractal=10000;

else

if(v2<=2500 && v2>250 )

fractal=1000;

else

if(v2<=250 && v2>25 )

fractal=100;

else

if(v2<=25 && v2>12.5 )

fractal=12.5;

else

if(v2<=12.5 && v2>6.25)

fractal=12.5;

else

if(v2<=6.25 && v2>3.125 )

fractal=6.25;

else

if(v2<=3.125 && v2>1.5625 )

fractal=3.125;

else

if(v2<=1.5625 && v2>0.390625 )

fractal=1.5625;

else

if(v2<=0.390625 && v2>0)

fractal=0.1953125;

range=(v2-v1);

sum=MathFloor(MathLog(fractal/range)/MathLog(2));

octave=fractal*(MathPow(0.5,sum));

mn=MathFloor(v1/octave)*octave;

if((mn+octave)>v2 )

mx=mn+octave;

else

mx=mn+(2*octave);

// calculating xx

//x2

if((v1>=(3*(mx-mn)/16+mn)) && (v2<=(9*(mx-mn)/16+mn)) )

x2=mn+(mx-mn)/2;

else x2=0;

//x1

if((v1>=(mn-(mx-mn)/8))&& (v2<=(5*(mx-mn)/8+mn)) && (x2==0) )

x1=mn+(mx-mn)/2;

else x1=0;

//x4

if((v1>=(mn+7*(mx-mn)/16))&& (v2<=(13*(mx-mn)/16+mn)) )

x4=mn+3*(mx-mn)/4;

else x4=0;

//x5

if((v1>=(mn+3*(mx-mn)/8))&& (v2<=(9*(mx-mn)/8+mn))&& (x4==0) )

x5=mx;

else x5=0;

//x3

if((v1>=(mn+(mx-mn)/8))&& (v2<=(7*(mx-mn)/8+mn))&& (x1==0) && (x2==0) && (x4==0) && (x5==0) )

x3=mn+3*(mx-mn)/4;

else x3=0;

//x6

if((x1+x2+x3+x4+x5) ==0 )

x6=mx;

else x6=0;

finalH=x1+x2+x3+x4+x5+x6;

// calculating yy

//y1

if(x1>0 )

y1=mn;

else y1=0;

//y2

if(x2>0 )

y2=mn+(mx-mn)/4;

else y2=0;

//y3

if(x3>0 )

y3=mn+(mx-mn)/4;

else y3=0;

//y4

if(x4>0 )

y4=mn+(mx-mn)/2;

else y4=0;

//y5

if(x5>0 )

y5=mn+(mx-mn)/2;

else y5=0;

//y6

if((finalH>0) && ((y1+y2+y3+y4+y5)==0) )

y6=mn;

else y6=0;

//----

finalL=y1+y2+y3+y4+y5+y6;

for( i=0; i<OctLinesCnt; i++)

{

mml[i]=0;

}

dmml=(finalH-finalL)/8;

Print("MMLevls : NewPeriod = ",NewPeriod," dmml = ",dmml," finalL = ",finalL);

mml[0] =(finalL-dmml*2); //-2/8

for( i=1; i<OctLinesCnt; i++)

{

mml[i]=mml[i-1] + dmml;

}

for( i=0; i<OctLinesCnt; i++ )

{

buff_str="mml"+i;

if(ObjectFind(buff_str)==-1)

{

ObjectCreate(buff_str, OBJ_HLINE, 0, Time[0], mml[i]);

ObjectSet(buff_str, OBJPROP_STYLE, STYLE_SOLID);

ObjectSet(buff_str, OBJPROP_COLOR, mml_clr[i]);

ObjectSet(buff_str, OBJPROP_WIDTH, mml_wdth[i]);

ObjectMove(buff_str, 0, Time[0], mml[i]);

}

else

{

ObjectMove(buff_str, 0, Time[0], mml[i]);

}

buff_str="mml_txt"+i;

if(ObjectFind(buff_str)==-1)

{

ObjectCreate(buff_str, OBJ_TEXT, 0, Time[mml_shft], mml_shft);

ObjectSetText(buff_str, ln_txt[i], 8, "Arial", mml_clr[i]);

ObjectMove(buff_str, 0, Time[mml_shft], mml[i]);

}

else

{

ObjectMove(buff_str, 0, Time[mml_shft], mml[i]);

}

} // for( i=1; i<=OctLinesCnt; i++ ){

nTime =Time[0];

CurPeriod= Period();

//----

string buff_str="LR_LatestCulcBar";

if(ObjectFind(buff_str)==-1)

{

ObjectCreate(buff_str, OBJ_ARROW,0, Time[StepBack], Low[StepBack]-2*Point );

ObjectSet(buff_str, OBJPROP_ARROWCODE, MarkNumber);

ObjectSet(buff_str, OBJPROP_COLOR, MarkColor);

}

else

{

ObjectMove(buff_str, 0, Time[StepBack], Low[StepBack]-2*Point );

}

}

//---- End Of Program

return(0);

}

//+------------------------------------------------------------------+

Comments