//+----------------------------------------------------------------------------------+

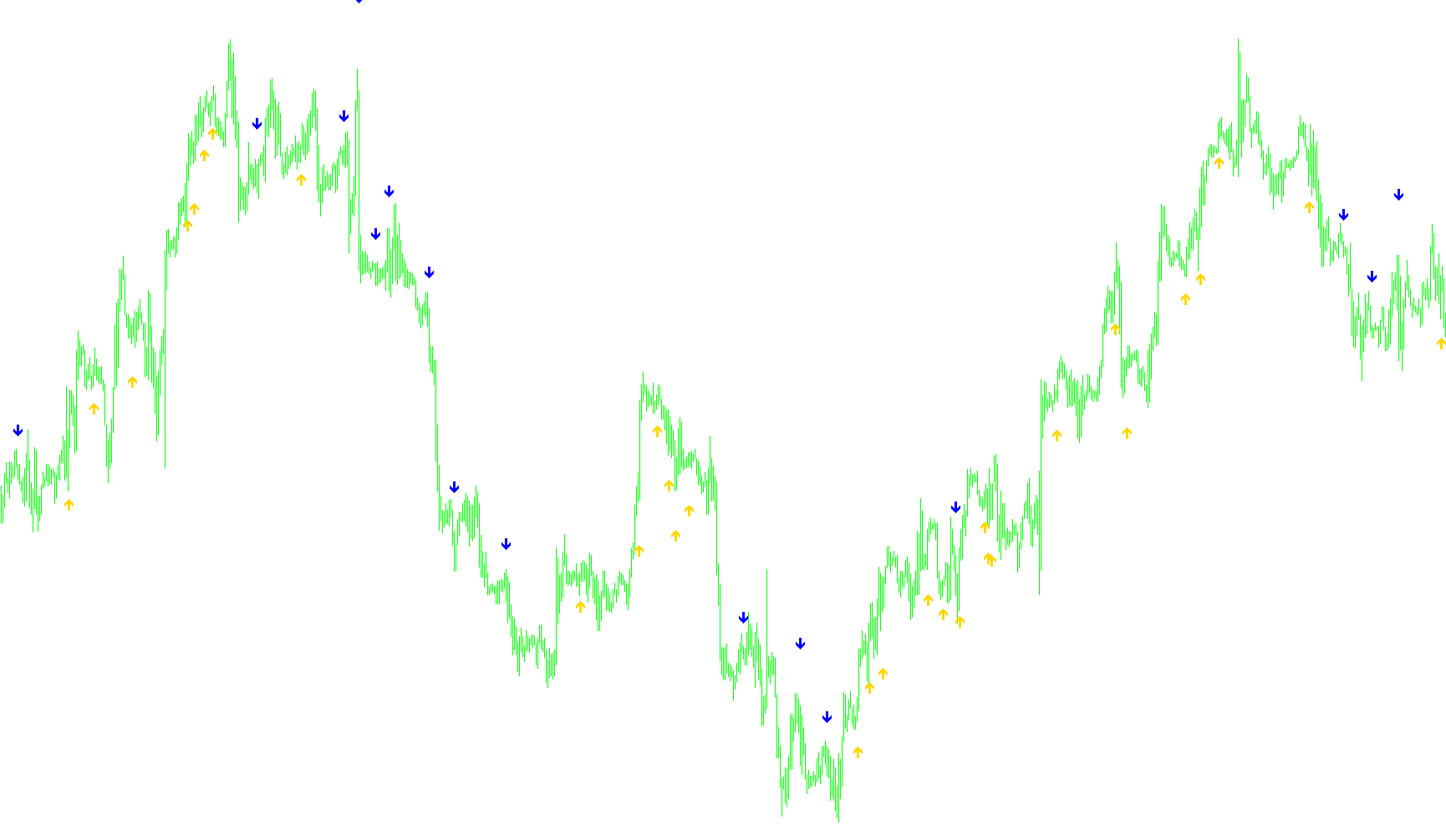

//| Stochastic CCI filtered crossed over indicator |

//+----------------------------------------------------------------------------------+

//| Stochastic CCI filtered crossed over.mq4 |

//| Copyright © 2008, Melvin Tan |

//| |

//+----------------------------------------------------------------------------------+

#property copyright "Melvin Tan"

#property link "none at the moment"

#property indicator_chart_window

#property indicator_buffers 2

#property indicator_color1 Blue

#property indicator_color2 Red

extern string note1 = "Stochastic settings";

extern int KPeriod1 = 5;

extern int DPeriod1 = 3;

extern int Slowing1 = 3;

extern string note2 = "0=sma, 1=ema, 2=smma, 3=lwma";

extern int MAMethod1 = 1;

extern string note3 = "0=high/low, 1=close/close";

extern int PriceField1 = 0;

extern int TrendCCI_Period = 50;

extern int EntryCCI_Period = 14;

extern bool AlertOn = false;

int bolPrd=20;

double bolDev=2.0;

int keltPrd=20;

double keltFactor=1.5;

double CrossUp[];

double CrossDown[];

string AlertPrefix;

string GetTimeFrameStr() {

switch(Period())

{

case 1 : string TimeFrameStr="M1"; break;

case 5 : TimeFrameStr="M5"; break;

case 15 : TimeFrameStr="M15"; break;

case 30 : TimeFrameStr="M30"; break;

case 60 : TimeFrameStr="H1"; break;

case 240 : TimeFrameStr="H4"; break;

case 1440 : TimeFrameStr="D1"; break;

case 10080 : TimeFrameStr="W1"; break;

case 43200 : TimeFrameStr="MN1"; break;

default : TimeFrameStr=Period();

}

return (TimeFrameStr);

}

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

//---- indicators

SetIndexStyle(0,DRAW_ARROW);

SetIndexArrow(0, 233);

SetIndexStyle(1,DRAW_ARROW);

SetIndexArrow(1, 234);

SetIndexBuffer(0, CrossUp);

SetIndexBuffer(1, CrossDown);

SetIndexEmptyValue(0,EMPTY_VALUE);

SetIndexEmptyValue(1,EMPTY_VALUE);

AlertPrefix=Symbol()+" ("+GetTimeFrameStr()+"): ";

//----

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

//----

//----

return(0);

}

//+------------------------------------------------------------------+

bool NewBar()

{

static datetime lastbar;

datetime curbar = Time[0];

if(lastbar!=curbar)

{

lastbar=curbar;

return (true);

}

else

{

return(false);

}

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start() {

int limit, i, counter;

double stochastic1now, stochastic2now, stochastic1previous, stochastic2previous, stochastic1after, stochastic2after;

double Range, AvgRange;

double TrendCCI, EntryCCInow, EntryCCIprevious;

double diff, std, bbs;

int counted_bars=IndicatorCounted();

//---- check for possible errors

if(counted_bars<0) return(-1);

//---- last counted bar will be recounted

if(counted_bars>0) counted_bars--;

limit=Bars-counted_bars;

for(i = 0; i <= limit; i++) {

counter=i;

Range=0;

AvgRange=0;

for (counter=i ;counter<=i+9;counter++)

{

AvgRange=AvgRange+MathAbs(High[counter]-Low[counter]);

}

Range=AvgRange/10;

diff = iATR(NULL,0,keltPrd,i)*keltFactor;

std = iStdDev(NULL,0,bolPrd,MODE_SMA,0,PRICE_CLOSE,i);

bbs = bolDev * std / diff; //Bollinger Squeeze

stochastic1now = iStochastic(NULL,0,KPeriod1,DPeriod1,Slowing1,MAMethod1,PriceField1,0,i);

stochastic1previous = iStochastic(NULL,0,KPeriod1,DPeriod1,Slowing1,MAMethod1,PriceField1,0,i+1);

stochastic2now = iStochastic(NULL,0,KPeriod1,DPeriod1,Slowing1,MAMethod1,PriceField1,1,i);

stochastic2previous = iStochastic(NULL,0,KPeriod1,DPeriod1,Slowing1,MAMethod1,PriceField1,1,i+1);

TrendCCI = iCCI(NULL, 0, TrendCCI_Period, PRICE_TYPICAL, i);

EntryCCInow = iCCI(NULL, 0, EntryCCI_Period, PRICE_TYPICAL, i);

EntryCCIprevious = iCCI(NULL, 0, EntryCCI_Period, PRICE_TYPICAL, i+1);

if ((stochastic1now > stochastic2now) && (stochastic1previous < stochastic2previous) && (TrendCCI > 0) && (EntryCCInow > EntryCCIprevious) && (bbs > 1))

{

CrossUp[i] = Low[i] - Range*1.5;

if (AlertOn && NewBar()) {

Alert(AlertPrefix+"Stoch ("+KPeriod1+","+DPeriod1+","+Slowing1+") %K crosses UP %D\nBUY signal @ Ask = ",Ask,"; Bid = ",Bid,"\nDate & Time = ",TimeToStr(CurTime(),TIME_DATE)," ",TimeHour(CurTime()),":",TimeMinute(CurTime()));

}

}

else if ((stochastic1now < stochastic2now) && (stochastic1previous > stochastic2previous) && (TrendCCI < 0) && (EntryCCInow < EntryCCIprevious) && (bbs > 1))

{

CrossDown[i] = High[i] + Range*1.5;

if (AlertOn && NewBar()){

Alert(AlertPrefix+"Stoch ("+KPeriod1+","+DPeriod1+","+Slowing1+") %K crosses DOWN %D\nSELL signal @ Ask = ",Ask,"; Bid = ",Bid,"\nDate & Time = ",TimeToStr(CurTime(),TIME_DATE)," ",TimeHour(CurTime()),":",TimeMinute(CurTime()));

}

}

else

{

CrossUp[i] = EMPTY_VALUE;

CrossDown[i] = EMPTY_VALUE;

}

}

return(0);

}

Comments