//+------------------------------------------------------------------+

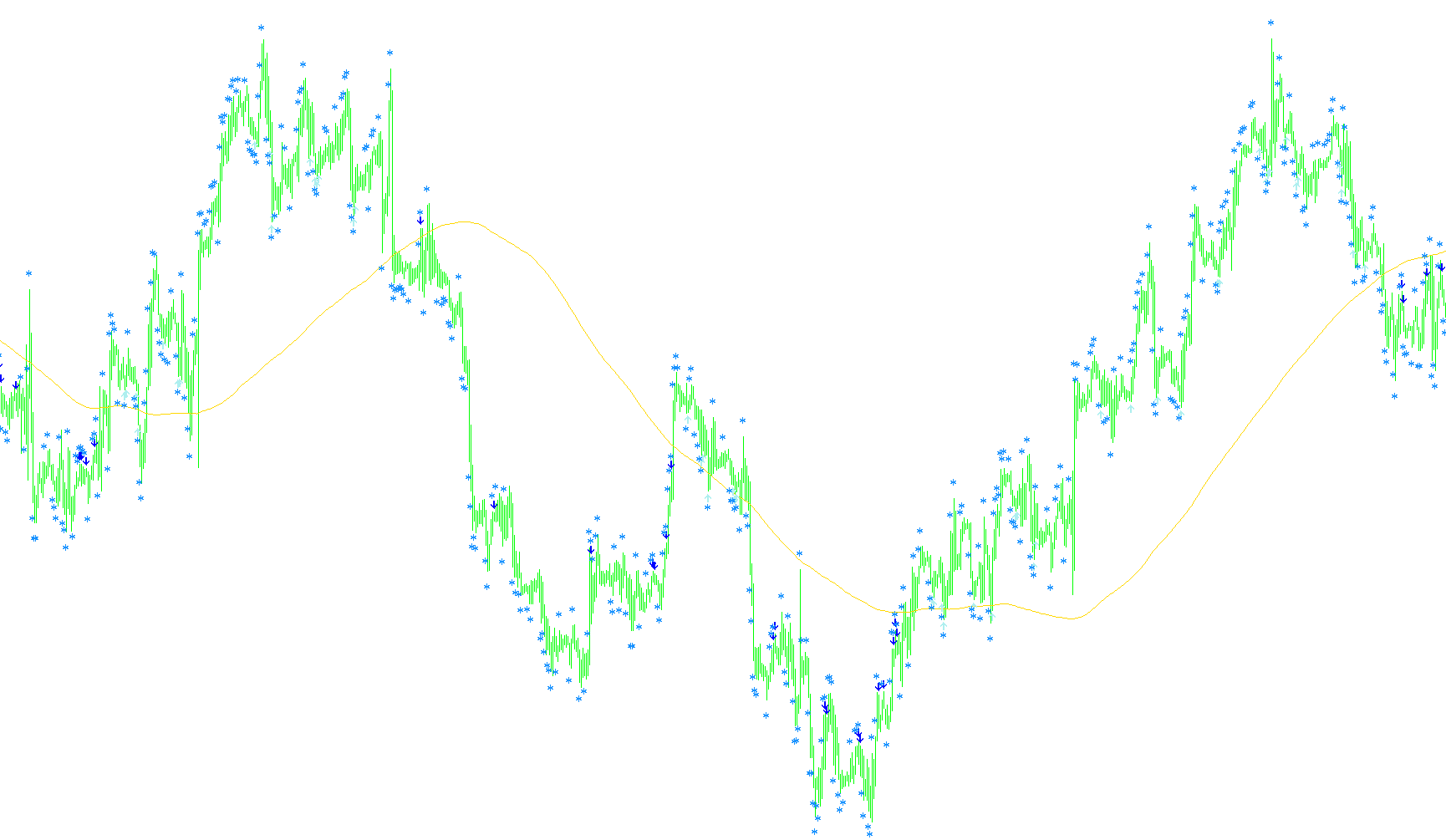

//| R2_Arrows_v4a.mq4 |

//| Copyright © 2007 , transport_david , David W Honeywell |

//| hellonwheels.trans@gmail.com |

//+------------------------------------------------------------------+

#property copyright "Copyright © 2007 , transport_david , David W Honeywell"

#property link "hellonwheels.trans@gmail.com"

#property indicator_chart_window

#property indicator_buffers 4

#property indicator_color1 Yellow

#property indicator_color2 Red

#property indicator_color3 Lime

#property indicator_color4 LightGray

extern bool Use_Hull = false;

extern string s1 = "---------------";

extern int Ma_Periods = 200;

extern int Ma_Type_if_not_Hull = 0; // only if Use_Hull = false

extern int Ma_Applied_Price = 0;

extern string s2 = "---------------";

extern int RsiPeriods = 2;

extern int Rsi_Applied_Price = 0;

extern string s3 = "---------------";

extern int BuyIfDay1RsiBelow = 65; // 1st day of tracking must be < this setting

extern int BuyIfDay3RsiBelow = 65; // 3rd day must be < this setting

extern string s4 = "---------------";

extern int SellIfDay1RsiAbove = 35; // 1st day of tracking must be > this setting

extern int SellIfDay3RsiAbove = 35; // 3rd day must be > this setting

extern string s5 = "---------------";

extern int CloseBuyIfRsiAbove = 75;

extern int CloseSellIfRsiBelow = 25;

extern string s6 = "---------------";

extern int ShowBars = 10000;

double Trend_Ma[];

double Sell_Arrow[];

double Buy_Arrow[];

double Close_Trade_Marker[];

double Calc[];

double prevtime;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

//---- indicators

IndicatorBuffers(5);

SetIndexStyle(0,DRAW_LINE,STYLE_SOLID,1);

SetIndexEmptyValue(0,0.0);

SetIndexBuffer(0,Trend_Ma);

SetIndexLabel(0,"Trend_Ma_Periods ( "+Ma_Periods+" )");

SetIndexEmptyValue(1,0.0);

SetIndexStyle(1,DRAW_ARROW,STYLE_SOLID,0);

SetIndexArrow(1,234);

SetIndexBuffer(1,Sell_Arrow);

SetIndexLabel(1,"Sell_Arrow ( RsiPeriods "+RsiPeriods+" )");

SetIndexEmptyValue(2,0.0);

SetIndexStyle(2,DRAW_ARROW,STYLE_SOLID,0);

SetIndexArrow(2,233);

SetIndexBuffer(2,Buy_Arrow);

SetIndexLabel(2,"Buy_Arrow ( RsiPeriods "+RsiPeriods+" )");

SetIndexEmptyValue(3,0.0);

SetIndexStyle(3,DRAW_ARROW,STYLE_SOLID,0);

SetIndexArrow(3,172);

SetIndexBuffer(3,Close_Trade_Marker);

SetIndexLabel(3,"Close_Trade_Marker");

SetIndexEmptyValue(4,0.0);

SetIndexBuffer(4,Calc);

//----

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

//----

//----

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

//----

int shift = ShowBars;

if (ShowBars > Bars) ShowBars = Bars;

for ( shift = ShowBars; shift >= 0; shift-- )

{

double Exp = 2;

double firstwma = iMA(Symbol(),0,MathFloor(Ma_Periods/2),0,MODE_LWMA,Ma_Applied_Price,shift);

double secondwma = iMA(Symbol(),0,Ma_Periods,0,MODE_LWMA,Ma_Applied_Price,shift);

Calc[shift] = (Exp*firstwma)-secondwma;

}

if (Use_Hull)

{

for ( shift = ShowBars; shift >= 0; shift-- )

{

Trend_Ma[shift] = iMAOnArray(Calc,0,MathFloor(MathSqrt(Ma_Periods)),0,MODE_LWMA,shift);

if (prevtime != Time[0]) { RefreshRates(); prevtime=Time[0]; }

double Day1 = iRSI(Symbol(),0,RsiPeriods,Rsi_Applied_Price,shift+3);

double Day2 = iRSI(Symbol(),0,RsiPeriods,Rsi_Applied_Price,shift+2);

double Day3 = iRSI(Symbol(),0,RsiPeriods,Rsi_Applied_Price,shift+1);

double Today = iRSI(Symbol(),0,RsiPeriods,Rsi_Applied_Price,shift);

//- Sell Arrows ---

if ( (iClose(Symbol(),0,shift+1) < Trend_Ma[shift+1]) && (Day1 > SellIfDay1RsiAbove) && (Day2 > Day1) && (Day3 > Day2) && (Day3 > SellIfDay3RsiAbove) )

Sell_Arrow[shift] = iHigh(Symbol(),0,shift) + (20*Point);//High arrow Sell

//- Buy Arrows ---

if ( (iClose(Symbol(),0,shift+1) > Trend_Ma[shift+1]) && (Day1 < BuyIfDay1RsiBelow) && (Day2 < Day1) && (Day3 < Day2) && (Day3 < BuyIfDay3RsiBelow) )

Buy_Arrow[shift] = iLow(Symbol(),0,shift) - (20*Point);//Low arrow Buy

//- Close Trades Marker ---

if (Today < CloseSellIfRsiBelow)

Close_Trade_Marker[shift] = iLow(Symbol(),0,shift) - (50*Point);

if (Today > CloseBuyIfRsiAbove)

Close_Trade_Marker[shift] = iHigh(Symbol(),0,shift) + (50*Point);

}

return(0);

}

if (!Use_Hull)

{

for ( shift = ShowBars; shift >= 0; shift-- )

{

Trend_Ma[shift] = iMA( Symbol(), 0, Ma_Periods, 0, Ma_Type_if_not_Hull, Ma_Applied_Price, shift);

if (prevtime != Time[0]) { RefreshRates(); prevtime=Time[0]; }

Day1 = iRSI(Symbol(),0,RsiPeriods,Rsi_Applied_Price,shift+3);

Day2 = iRSI(Symbol(),0,RsiPeriods,Rsi_Applied_Price,shift+2);

Day3 = iRSI(Symbol(),0,RsiPeriods,Rsi_Applied_Price,shift+1);

Today = iRSI(Symbol(),0,RsiPeriods,Rsi_Applied_Price,shift);

//- Sell Arrows ---

if ( (iClose(Symbol(),0,shift+1) < Trend_Ma[shift+1]) && (Day1 > SellIfDay1RsiAbove) && (Day2 > Day1) && (Day3 > Day2) && (Day3 > SellIfDay3RsiAbove) )

Sell_Arrow[shift] = iHigh(Symbol(),0,shift) + (20*Point); // High arrow Sell

//- Buy Arrows ---

if ( (iClose(Symbol(),0,shift+1) > Trend_Ma[shift+1]) && (Day1 < BuyIfDay1RsiBelow) && (Day2 < Day1) && (Day3 < Day2) && (Day3 < BuyIfDay3RsiBelow) )

Buy_Arrow[shift] = iLow(Symbol(),0,shift) - (20*Point); // Low arrow Buy

//- Close Trades Marker ---

if (Today < CloseSellIfRsiBelow)

Close_Trade_Marker[shift] = iLow(Symbol(),0,shift) - (50*Point);

if (Today > CloseBuyIfRsiAbove)

Close_Trade_Marker[shift] = iHigh(Symbol(),0,shift) + (50*Point);

}

return(0);

}

//----

return(0);

}

//+------------------------------------------------------------------+

Comments