//+------------------------------------------------------------------+

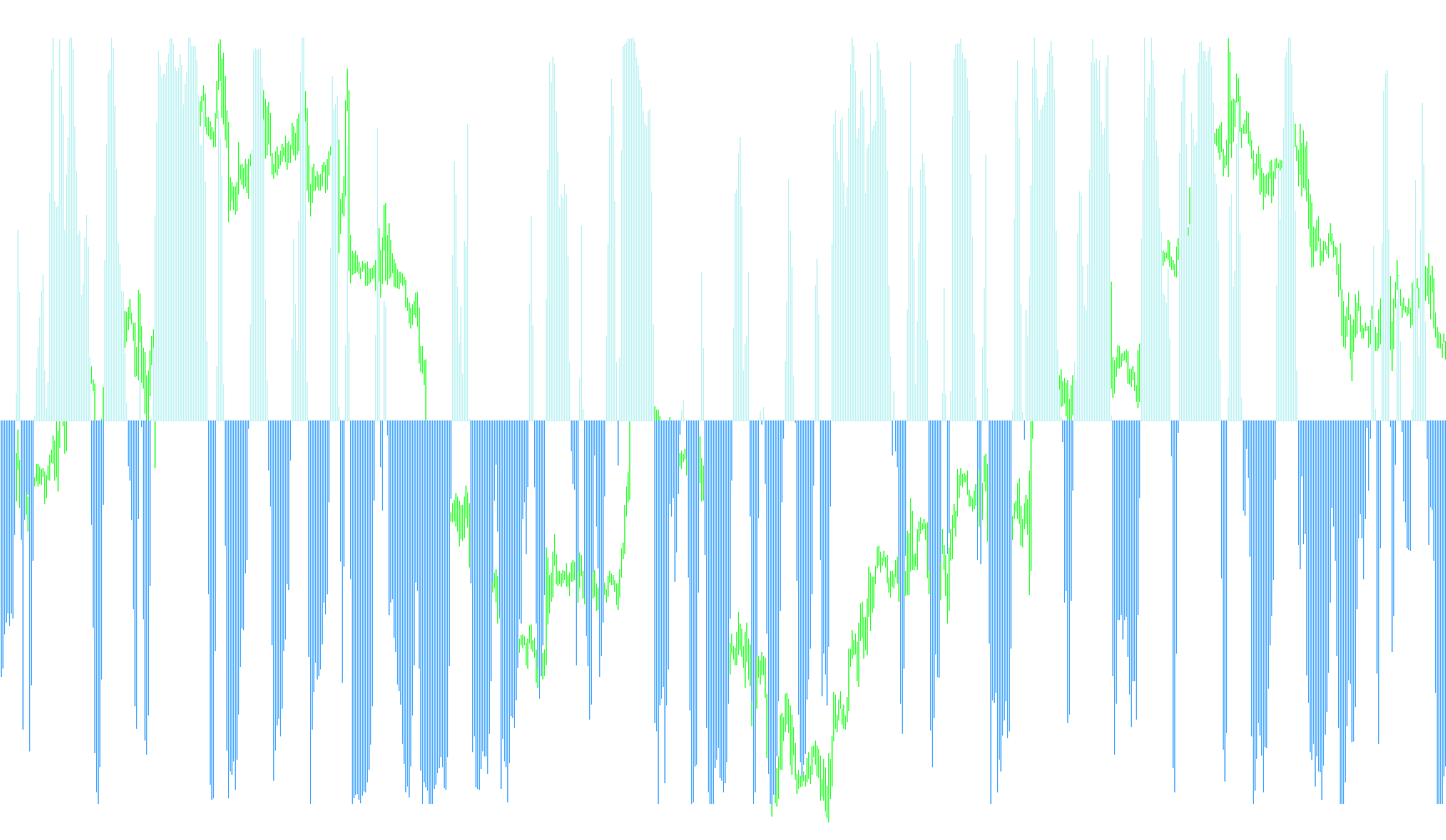

//| KawaseOsyo_StochasticHistgram.mq4 |

//| Copyright © 2011, KawaseOsyo, Syotaro Yoshida |

//| http://www.kawaseosyo.com/ |

//+------------------------------------------------------------------+

#property copyright "Copyright By KawaseOsyo,TransEdge co.,Ltd."

#property link "http://www.kawaseosyo.com/"

#property indicator_separate_window

#property indicator_buffers 4

#property indicator_color1 Orange

#property indicator_color2 White

#property indicator_color3 RoyalBlue

#property indicator_color4 Red

#property indicator_style1 STYLE_SOLID

#property indicator_style2 STYLE_SOLID

#property indicator_style3 STYLE_SOLID

#property indicator_style4 STYLE_SOLID

#property indicator_width1 1

#property indicator_width2 1

#property indicator_width3 3

#property indicator_width4 3

// ¡¡¡ xC

#property indicator_levelcolor DarkGray

#property indicator_maximum 100

#property indicator_minimum -100

#define OVER_BOUGHT 50

#define OVER_SOLD 50

// ¡¡¡ p[^

extern string URL = "www.kawaseosyo.com";

extern int KPeriod = 14; // %K

extern int DPeriod = 3; // %D

extern int Slowing = 3; // Slow Stochastic

// ¡¡¡ obt@

double m_factorK[];

double m_factorD[];

double m_up[];

double m_down[];

// ¡¡¡¡¡¡¡¡¡ úÝè ¡¡¡¡¡¡¡¡¡

int init()

{

// ¡¡¡ obt@Ýè

SetIndexBuffer( 0, m_factorK ); // %K

SetIndexBuffer( 1, m_factorD ); // %D

SetIndexBuffer( 2, m_up ); // Up

SetIndexBuffer( 3, m_down ); // Down

// ¡¡¡ `æ

SetIndexStyle ( 0, DRAW_NONE );// %K

SetIndexStyle ( 1, DRAW_NONE );// %D

SetIndexStyle ( 2, DRAW_HISTOGRAM );// Stochastic Up (%K)

SetIndexStyle ( 3, DRAW_HISTOGRAM );// Stochastic Down(%K)

SetIndexLabel ( 0, "%K" );

SetIndexLabel ( 1, "%D" );

SetIndexLabel ( 2, "Stochastic Up");

SetIndexLabel ( 3, "Stochastic Down");

// ¡¡¡ CWP[^¼Ýè

string shortName = "KawaseOsyo Stochastic Histogram(" + KPeriod +","+ DPeriod +","+ Slowing +")";

return(0);

}

// ¡¡¡¡¡¡¡¡¡ C ¡¡¡¡¡¡¡¡¡

int start()

{

int limit = Bars - IndicatorCounted();

if(IndicatorCounted()<0) return(-1);

// ¡¡¡ XgLXvZ

for( int j=limit ; j>=0 ; j--){

m_factorK[j] = iStochastic( NULL, 0, KPeriod, DPeriod, Slowing, MODE_SMA, 1, MODE_MAIN, j);

m_factorD[j] = iStochastic( NULL, 0, KPeriod, DPeriod, Slowing, MODE_SMA, 1, MODE_SIGNAL,j);

}

// ¡¡¡ XgLXÌFï

for( int i=limit ; i>=0; i--){

m_up[i]=EMPTY_VALUE;

m_down[i]=EMPTY_VALUE;

// ¡¡¡ Abvgh

if( m_factorK[i] > OVER_BOUGHT ){

m_up[i] = GetValue(m_factorK[i]);

}

// ¡¡¡ _Egh

if( m_factorK[i] < OVER_SOLD ){

m_down[i] = GetValue(m_factorK[i]);

}

}

return(0);

}

// ¡¡¡¡¡¡¡¡¡ XgLXÌlÏ· ¡¡¡¡¡¡¡¡¡

double GetValue( double value )

{

return( (value-OVER_BOUGHT)*2.0);

}

Comments