/*+-------------------------------------------------------------------+

| iMAX3alert.mq4 |

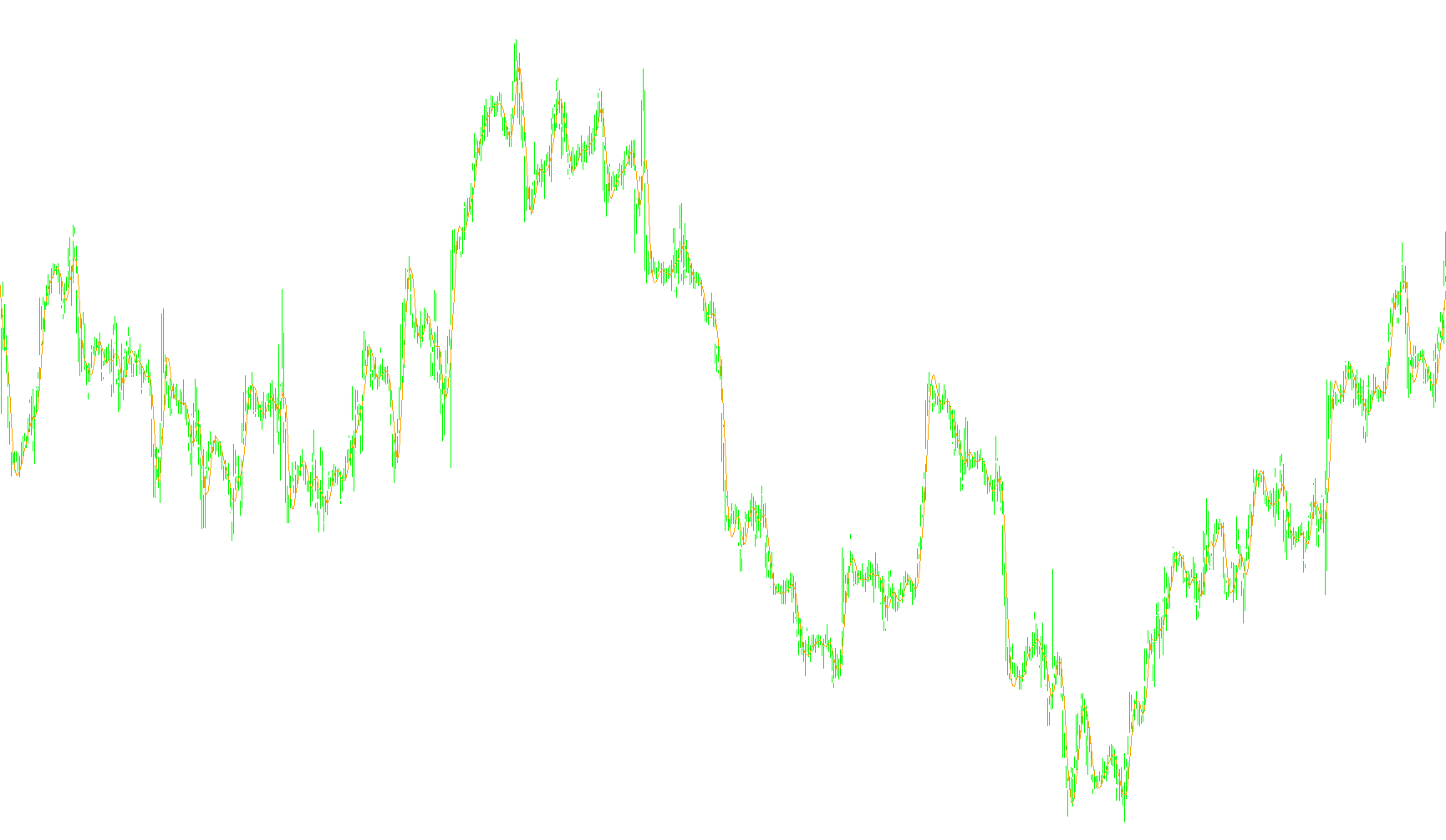

| Based upon the iMAX3 indicator. |

| |

| In this alert version only one of the three modes available can |

| selected at a time in order to generate optional display arrows |

| and alerts on a phase crossing/fast trend change. |

| |

| The iMAX mode is the most adaptive, but the least responsive in |

| terms of speed of detection of a trend change of the three modes. |

| However, it is a good all around choice, especially in highly |

| volatile markets. |

| |

| The iMAXhp mode is a faster trend detector, adaptive, but less |

| immune to spikes in prices than the iMAX mode (More easily |

| whipsawed by price action). It is a good compromise between trend |

| detection speed/filtering. |

| |

| The iMAXhpx mode is the fastest trend detector, but because it |

| follows price action so closely, it will change trends very |

| rapidly at times... even in less volatile markets. So it is |

| probably not a good choice for alerts, in the lower time frames...|

| under almost any circumstances, but might work out in higher time |

| frames... so, it is available. |

| |

| It is up to the user to select an appropriate mode for the |

| desired speed of detection and price action filtering, for the |

| security and time frame that alerts are to be generated for. | |

| |

| Alerts and arrows are generated on the open bar... that means |

| they can change as price changes on that bar. Once the bar |

| closes, the arrow becomes fixed. Alerts are generated on the |

| first alert event on the open bar, giving the earliest possible |

| warning of a possible trend change, but thereafter may not be |

| triggered again until bar closing... this is done to strike a |

| compromise in favor of an early alert. Price can move back and |

| forth over a phase crossing on an open bar generating repititious |

| alerts, that most traders find irritating. However, an alert |

| generated on a closed bar may come to late to do any good for a |

| trader... So, the compromise is to alert the trader to the first |

| crossing event on the open bar... and then they know to watch |

| what happens after that, on that bar, because until a new bar |

| forms, there may not be another alert generated. This is a |

| "heads up" alert system. |

| |

| Twenty currency pairs have been checked for compantibility with |

| the preset amplitude settings for the hp modes. In that group, |

| two currencies, the Mexican Peso, and the Japanese Yen are |

| treated as exceptions, with unique settings provided for in |

| those cases. So, this version of the iMAX indicator is a good |

| example of how to handle programming the amplitude phase shifts |

| for the hp trend detection modes. |

| |

| iMAX mode 0 will automatically handle any security or commodity |

| pair detected that hp modes are not programmed for. |

| |

| This version is liberally commented to help in fully understanding|

| the iMAX indicator in practical usage. |

| |

| "Modified Optimum Elliptic Filter" ref: | |

| Source of calculations; |

| Stocks & Commodities vol 18:7 p20-29 |

| Optimal Detrending by John F. Ehlers |

| |

| Crafted by Wylie |

| Copyright © 2009 |

| dazzle.html@live.com |

+-------------------------------------------------------------------+*/

#property copyright "Copyright © 2009, Wylie"

#property link "dazzle.html@live.com"

#property indicator_chart_window

#property indicator_buffers 8

#property indicator_color1 Lime

#property indicator_width1 1

#property indicator_color2 HotPink

#property indicator_width2 1

#property indicator_color3 White

#property indicator_width3 1

#property indicator_color4 Orange

#property indicator_width4 1

#property indicator_color5 Aqua

#property indicator_width5 1

#property indicator_color6 Red

#property indicator_width6 1

#property indicator_color7 Aqua

#property indicator_width7 1

#property indicator_color8 Red

#property indicator_width8 1

/*+-------------------------------------------------------------------+

| iMAX3alert Parameters |

+-------------------------------------------------------------------+*/

extern string _0 = "";

bool EnableAlerts = false;

bool EnableArrows = false;

int ArrowUPsize = 1;

int ArrowDNsize = 1;

color ArrowUPcolor = Aqua;

color ArrowDNcolor = Red;

string _1 = "";

string _2 = "Select Mode";

string _3 = "iMAX mode = 0";

string _4 = "hp mode = 1";

string _5 = "hpx mode = 2";

int Mode_user = 1;

string _6 = "";

string _7 = "Display phases on chart";

bool ChartPhases = true;

string _8 = "";

string _9 = "Amplitude shift for hp modes.";

string _10 = "0.0 = Use internal presets.";

double Ph1stepHPmodes = 0.0;

string _11 = "";

color hpxPh1color = Lime;

color hpxPh2color = HotPink;

string _12 = "";

color hpPh1color = White;

color hpPh2color = Orange;

string _13 = "";

color iMAXph1color = Aqua;

color iMAXph2color = Red;

bool ModeFault = false, // Used to flag an incorrect mode selection by the user.

Mode; // Used to switch over to mode 0, if hp modes are not programmed to handle a security pair.

// indicator buffers

double iMAX0[10000],iMAX1[10000],hp0[],hp1[],hpx0[],hpx1[],CrossUp[10000],CrossDn[10000],

Clearance, // Used to set clearance distance for arrows above or below price on the chart.

Ph1step, // Phase 1 amplitude modulation value for hp modes.

x, // Available for use as a temporary variable.

xhp0,xhp1, // Used to compensate for 180 degree phase difference between iMAX and hp mode.

b0,b1,r0,r1; // Used to interface phases to arrow and alert logic.

int MinBars,limit,countedBars,

AST, // Alert stop time. Time filter period to prevent repetitious alerts from occurring.

c, // Integer variable used for counting.

sym, // Integer identifying either JPY, MXN, or all other securities (states 1 thru 3).

NumSym; // Number of authorized securities.

string SymList[20], // Array containing authorized security pairs.

symStr, // Truncated symbol string to identify one security from the symbol pair.

Chart; // Used by alert function to identify the chart reporting the alert.

static datetime AlertX[3]; // Array used ot store alert event time flags.

/*+-------------------------------------------------------------------+

| iMAX3alert Initialization |

+-------------------------------------------------------------------+*/

int init()

{

SymList[0] = "AUDCAD"; // Symbols this indicator has been checked to function with.

SymList[1] = "AUDNZD"; // Other symbols can be added or substituted here if the

SymList[2] = "AUDJPY"; // securities pose no problems for the Ph1step amplitude

SymList[3] = "AUDUSD"; // settings for the hp modes. That can be modified too, if necessatry.

SymList[4] = "CADJPY";

SymList[5] = "CHFJPY";

SymList[6] = "EURAUD";

SymList[7] = "EURCAD";

SymList[8] = "EURCHF";

SymList[9] = "EURGBP";

SymList[10] = "EURJPY";

SymList[11] = "EURUSD";

SymList[12] = "GBPCHF";

SymList[13] = "GBPJPY";

SymList[14] = "GBPUSD";

SymList[15] = "NZDUSD";

SymList[16] = "USDCAD";

SymList[17] = "USDCHF";

SymList[18] = "USDMXN";

SymList[19] = "USDJPY";

SymList[20] = "USDTRY";NumSym = 20;

if(ModeFault)

{Mode_user = 0;Mode = 0;ModeFault = false;}

if((Mode_user == 1 || Mode_user == 2) && !GoSym())

{sendAlert(3,("iMAX3alert: HP modes not programmed to function with this Symbol. Switching to mode 0."));

Mode = 0;}

else

{Mode = Mode_user;}

IndicatorBuffers(8);

if(Mode == 2) // Not initializing these buffers unless hpxMode mode is selected.

{SetIndexBuffer(0,hpx0);

SetIndexBuffer(1,hpx1);

if(ChartPhases) // Display phases in chart price area

{SetIndexStyle(0,DRAW_LINE,STYLE_SOLID,1,hpxPh1color);

SetIndexStyle(1,DRAW_LINE,STYLE_SOLID,1,hpxPh2color);}

else // Do not Display phases in chart price area

{SetIndexStyle(0,DRAW_NONE);

SetIndexStyle(1,DRAW_NONE);}}

if(Mode == 1) // Not initializing these buffers unless hpMode mode is selected.

{SetIndexBuffer(2,hp0);

SetIndexBuffer(3,hp1);

if(ChartPhases) // Display phases in chart price area

{SetIndexStyle(2,DRAW_LINE,STYLE_SOLID,1,hpPh1color);

SetIndexStyle(3,DRAW_LINE,STYLE_SOLID,1,hpPh2color);}

else // Do not Display phases in chart price area

{SetIndexStyle(2,DRAW_NONE);

SetIndexStyle(3,DRAW_NONE);}}

SetIndexBuffer(4,iMAX0);

SetIndexBuffer(5,iMAX1);

if(Mode == 0 && ChartPhases) // Display phases in chart price area

{SetIndexStyle(4,DRAW_LINE,STYLE_SOLID,1,iMAXph1color);

SetIndexStyle(5,DRAW_LINE,STYLE_SOLID,1,iMAXph2color);}

else // Do not Display phases in chart price area

{SetIndexStyle(4,DRAW_NONE);

SetIndexStyle(5,DRAW_NONE);}

if(EnableArrows) // Not initializing these buffers unless arrows generation is selected.

{SetIndexBuffer(6,CrossUp);

SetIndexStyle(6,DRAW_ARROW,STYLE_SOLID,ArrowUPsize,ArrowUPcolor);

SetIndexArrow(6,221);

SetIndexBuffer(7,CrossDn);

SetIndexStyle(7,DRAW_ARROW,STYLE_SOLID,ArrowDNsize,ArrowDNcolor);

SetIndexArrow(7,222);}

symStr = StringSubstr(Symbol(),3,3); // Extract the portion of the symbol string that may contain

// references to JPY or MXN securities.

sym = 0; // Set an integer to identify JPY, MXN, or other securities.

if(symStr == "MXN"){sym = 1;}

if(symStr == "JPY"){sym = 2;}

if(Mode == 1 || Mode == 2) // Set phase amplitude values if an hp mode is selected.

{if(Ph1stepHPmodes == 0.0) // If no external amplitude is specified...

{switch(sym) // Select values for JPY, MXN, or all other securites.

{case 0: // Securities other than JPY or MXN

switch(Period()) // Phase 1 amplitude values for each time frame for security pairs other than JPY and MXN.

{case 1: Ph1step = 0.0001; Clearance = 0.0003; break;

case 5: Ph1step = 0.00015; Clearance = 0.0005; break;

case 15: Ph1step = 0.0003; Clearance = 0.0009; break;

case 30: Ph1step = 0.0005; Clearance = 0.0015; break;

case 60: Ph1step = 0.00075; Clearance = 0.0025; break;

case 240: Ph1step = 0.0015; Clearance = 0.004; break;

case 1440: Ph1step = 0.003; Clearance = 0.007; break;

case 10080: Ph1step = 0.005; Clearance = 0.014; break;

case 43200: Ph1step = 0.01; Clearance = 0.026; break;}break;

case 1: // MXN securities

switch(Period()) // Phase 1 amplitude values for each time frame of MXN paired securities.

{case 1: Ph1step = 0.001; Clearance = 0.003; break;

case 5: Ph1step = 0.0015; Clearance = 0.005; break;

case 15: Ph1step = 0.003; Clearance = 0.009; break;

case 30: Ph1step = 0.005; Clearance = 0.015; break;

case 60: Ph1step = 0.0075; Clearance = 0.025; break;

case 240: Ph1step = 0.015; Clearance = 0.04; break;

case 1440: Ph1step = 0.03; Clearance = 0.07; break;

case 10080: Ph1step = 0.05; Clearance = 0.14; break;

case 43200: Ph1step = 0.1; Clearance = 0.26; break;}break;

case 2: // JPY securities

switch(Period()) // Phase 1 amplitude values for each time frame of JPY paired securities.

{case 1: Ph1step = 0.01; Clearance = 0.03; break;

case 5: Ph1step = 0.015; Clearance = 0.05; break;

case 15: Ph1step = 0.03; Clearance = 0.09; break;

case 30: Ph1step = 0.05; Clearance = 0.15; break;

case 60: Ph1step = 0.075; Clearance = 0.25; break;

case 240: Ph1step = 0.15; Clearance = 0.4; break;

case 1440: Ph1step = 0.3; Clearance = 0.7; break;

case 10080: Ph1step = 0.5; Clearance = 1.4; break;

case 43200: Ph1step = 1.0; Clearance = 2.6; break;}break;}}

else // Set amplitude via external parameter.

{Ph1step = Ph1stepHPmodes;}}

if(Mode == 0) // Set chart arrow clearances for mode 0

{switch(Period())

{case 1: Clearance = 0.0003; break;

case 5: Clearance = 0.0005; break;

case 15: Clearance = 0.0009; break;

case 30: Clearance = 0.0015; break;

case 60: Clearance = 0.0025; break;

case 240: Clearance = 0.004; break;

case 1440: Clearance = 0.007; break;

case 10080: Clearance = 0.014; break;

case 43200: Clearance = 0.026; break;}}

if(Mode == 0 && symStr == "MXN") // Set chart arrow clearances for mode 0 Mexican Peso

{switch(Period())

{case 1: Clearance = 0.003; break;

case 5: Clearance = 0.005; break;

case 15: Clearance = 0.009; break;

case 30: Clearance = 0.015; break;

case 60: Clearance = 0.025; break;

case 240: Clearance = 0.04; break;

case 1440: Clearance = 0.07; break;

case 10080: Clearance = 0.14; break;

case 43200: Clearance = 0.26; break;}}

if(Mode == 0 && symStr == "JPY") // Set chart arrow clearances for mode 0 Japanese Yen

{switch(Period())

{case 1: Clearance = 0.03; break;

case 5: Clearance = 0.05; break;

case 15: Clearance = 0.09; break;

case 30: Clearance = 0.15; break;

case 60: Clearance = 0.25; break;

case 240: Clearance = 0.4; break;

case 1440: Clearance = 0.7; break;

case 10080: Clearance = 1.4; break;

case 43200: Clearance = 2.6; break;}}

switch(Period()) // Set general time frame related settings. Chart is used in Alert text, and Alert Stop Time varies by bar time.

{case 1: Chart = "M1"; AST = 59; break;

case 5: Chart = "M5"; AST = 259; break;

case 15: Chart = "M15"; AST = 899; break;

case 30: Chart = "M30"; AST = 1799; break;

case 60: Chart = "H1"; AST = 3599; break;

case 240: Chart = "H4"; AST = 14399; break;

case 1440: Chart = "D1"; AST = 86399; break;

case 10080: Chart = "W1"; AST = 604799; break;

case 43200: Chart = "MN1"; AST = 2591999; break;}

MinBars = 20;

IndicatorShortName("iMAX3alert");

return (0);

} // int init()

/*+-------------------------------------------------------------------+

| iMAX3alert Main cycle |

+-------------------------------------------------------------------+*/

int start()

{

if(Bars <= MinBars)

{Alert("iMAX3alert: Not enough bars on the chart.");return (0);}

if(Mode < 0 || Mode > 2)

{if(!ModeFault)

{ModeFault = true;

Alert("iMAX3alert: User selected an invalid mode... switched to iMAX mode 0.");init();}}

else

{ModeFault = false;}

countedBars = IndicatorCounted();

if(countedBars < 0){return (-1);}

if(countedBars > 0){countedBars--;}

limit = Bars - countedBars - 1;

x = 0.5;

c = limit;

while(c >= 0)

{

// Perform Wylie's modified Ehlers' calculation when hpx mode is selected.

// Results are loaded into indicator buffers hpx0[] (phase 1) and hpx1[] (phase 2)

// Result is also phase compensated to agree with iMAX mode.

if(Mode == 2)

{hpx1[c] = (0.13785 * (2 * ((High[c] + Low[c]) * x) - ((High[c+1] + Low[c+1]) * x)))

+ (0.0007 * (2 * ((High[c+1] + Low[c+1]) * x) - ((High[c+2] + Low[c+2]) * x)))

+ (0.13785 * (2 * ((High[c+2] + Low[c+2]) * x) - ((High[c+3] + Low[c+3]) * x)))

+ (1.2103 * hpx0[c + 1] - 0.4867 * hpx0[c + 2]);

if(Close[c] > hpx1[c])

{hpx0[c] = hpx1[c] + Ph1step;}

if(Close[c] < hpx1[c])

{hpx0[c] = hpx1[c] - Ph1step;}

b0 = hpx0[c];b1 = hpx0[c+1];r0 = hpx1[c];r1 = hpx1[c+1];} // Copy phase values to arrow and alert interface variables.

// Perform Ehlers calculation when iMAXmode or hp mode is selected.

// Results are loaded into indicator buffers iMAX0[] (phase 1) and iMAX1[] (phase 2)

if(Mode == 0 || Mode == 1)

{iMAX0[c] = (0.13785 * (2 * ((High[c] + Low[c]) * x) - ((High[c+1] + Low[c+1]) * x)))

+ (0.0007 * (2 * ((High[c+1] + Low[c+1]) * x) - ((High[c+2] + Low[c+2]) * x)))

+ (0.13785 * (2 * ((High[c+2] + Low[c+2]) * x) - ((High[c+3] + Low[c+3]) * x)))

+ (1.2103 * iMAX0[c + 1] - 0.4867 * iMAX0[c + 2]);

xhp0 = iMAX0[c]; // Set this variable in case hp mode is selected.

// In hp mode the xhp0 variable is used to synthesize hp phases.

iMAX1[c] = iMAX0[c+1]; // Basic iMAX single bar phase shift.

b0 = iMAX0[c];b1 = iMAX0[c+1];r0 = iMAX1[c];r1 = iMAX1[c+1];} // Copy phase values to arrow and alert interface variables.

// Synthesize hp phases from iMAX0 phase 1 signal when hp mode is selected.

// Results are loaded into indicator buffers hp0[] (phase 1) and hp1[] (phase 2)

if(Mode == 1)

{if(Close[c] > iMAX0[c])

{xhp1 = iMAX0[c] + Ph1step;}

if(Close[c] < iMAX0[c])

{xhp1 = iMAX0[c] - Ph1step;}

hp0[c] = xhp1; // Phase compensate 180 degrees (So iMAX mode and hp mode agrees about up and down).

hp1[c] = xhp0;

b0 = hp0[c];b1 = hp0[c+1];r0 = hp1[c];r1 = hp1[c+1];} // Copy phase values to arrow and alert interface variables.

if(EnableArrows)

{if(b0 > r0 && b1 < r1)

{CrossUp[c] = r0 - Clearance;}else{CrossUp[c] = EMPTY_VALUE;}

if(b0 < r0 && b1 > r1)

{CrossDn[c] = r0 + Clearance;}else{CrossDn[c] = EMPTY_VALUE;}}

c--;

} // while(c >= 0)

if(EnableAlerts)

{if(b0 > r0 && b1 < r1)

{sendAlert(0,(StringConcatenate(getDateTime()," ",Symbol()," ",Chart," iMAX3alert signals up trend crossing.")));}

if(b0 < r0 && b1 > r1)

{sendAlert(1,(StringConcatenate(getDateTime()," ",Symbol()," ",Chart," iMAX3alert signals down trend crossing.")));}}

return (0);

} // int start()

/*+-------------------------------------------------------------------+

| End iMAX3alert Main cycle |

+-------------------------------------------------------------------+*/

/*+-------------------------------------------------------------------+

| iMAX3alert support functions |

+-------------------------------------------------------------------+*/

/*+-------------------------------------------------------------------+

| *** Alert processing function |

+-------------------------------------------------------------------+*/

void sendAlert(int AlertNum,string AlertText)

{

if(TimeCurrent() > AlertX[AlertNum] + AST)

{AlertX[AlertNum] = TimeCurrent();

/* Add a sound file here if you want another form of alert...

The sound file must be located in the MT4 "sounds" file folder

and must be a .wav format file. Also remove the // characters before

the PlaySound instruction. The Alert command and semicolon can

be removed if the user wishes to remove the alert entirely, if favor

of a sound file... or it can be "commented out" just add // before

the alert instruction. */

// PlaySound("YourFavoriteAlertSound.wav");

// Print(AlertText); // If using just the PlaySound alert print a copy of the alert message to the journal.

Alert(AlertText);

} // if(TimeCurrent() > AlertX[AlertNum] + AST)

return(0);

} // void sendAlert(int AlertNum,string AlertText)

/*+-------------------------------------------------------------------+

| *** Date/Time display function |

+-------------------------------------------------------------------+*/

string getDateTime()

{

string dsplyDateTime = TimeToStr(TimeCurrent(),TIME_DATE|TIME_SECONDS);

return(dsplyDateTime);

} // string getDateTime()

/*+-------------------------------------------------------------------+

| *** Symbol check function |

+-------------------------------------------------------------------+*/

bool GoSym()

{

bool Go = false;

for(c = 0;c <= NumSym;c++)

{if(Symbol() == SymList[c]){Go = true;}}

return(Go);

}

/*+-------------------------------------------------------------------+

| End iMAX3alert support functions |

+-------------------------------------------------------------------+*/

Comments