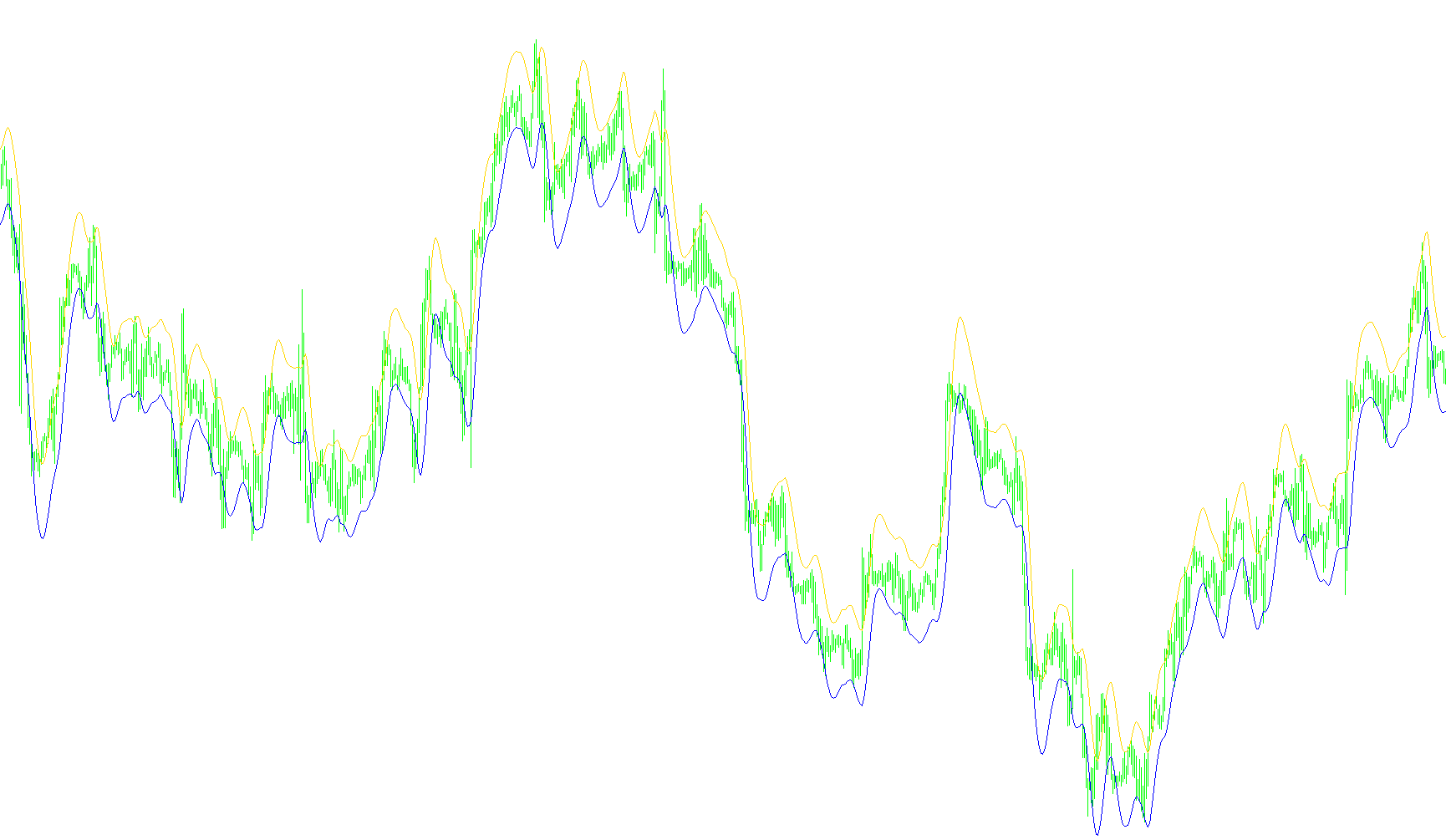

This script is designed to display an "envelope" on a trading chart. Think of an envelope as two lines drawn around a central line, indicating potential areas of price fluctuation. Here's how it works:

-

Input Parameters: The script starts by allowing the user to customize its behavior through a few key settings.

_maPeriod: This determines the length of the period used to calculate the main moving average, influencing the responsiveness of the envelope to price changes. A larger number smooths out the average, while a smaller number makes it more sensitive.deviation: This setting dictates how far away the upper and lower lines of the envelope are from the central line, expressed as a percentage. A larger deviation creates a wider envelope.price1andprice2: These parameters decide which price data (e.g., open, close, high, low) the script uses for calculations.

-

Hull Moving Average (HMA) Calculation:

- The script uses a variation of the moving average called the Hull Moving Average (HMA). The HMA aims to reduce lag compared to traditional moving averages, making it more responsive to recent price movements.

- It calculates two WMAs which are then used to calculate 2 more HMA to calculate the bands

-

Envelope Creation:

- The script calculates the "middle line" of the envelope using HMA. This line represents the central tendency of the price over the specified period.

- It then calculates the upper and lower bands by adding and subtracting the specified

deviationpercentage from the "middle line". This creates the visual "envelope" around the price action.

-

Visual Display: The script draws the upper and lower bands on the chart as lines. These lines visually represent the envelope around the price, providing a quick visual reference for potential price ranges.

/*-----------------------------+

| |

| Shared by www.Aptrafx.com |

| |

+------------------------------*/

//+------------------------------------------------------------------+

//| HMA envelope.mq4 |

//| Nick Bilak, beluck[AT]gmail.com |

//+------------------------------------------------------------------+

#property copyright "Copyright © 2006, Nick Bilak"

#property link "http://www.mql4.info"

#property indicator_chart_window

#property indicator_buffers 2

#property indicator_color1 Red

#property indicator_color2 Red

//---- External parameters

extern int _maPeriod=20;

extern double deviation = 0.1;

extern int price1 = PRICE_OPEN;

int price1shift = 0;

int price2shift = 0;

extern int price2 = PRICE_OPEN;

/*

PRICE_CLOSE 0 Close price.

PRICE_OPEN 1 Open price.

PRICE_HIGH 2 High price.

PRICE_LOW 3 Low price.

PRICE_MEDIAN 4 Median price, (high+low)/2.

PRICE_TYPICAL 5 Typical price, (high+low+close)/3.

PRICE_WEIGHTED 6 Weighted close price, (high+low+close+close)/4.

*/

//---- indicator buffers

double _hma[],_wma[],hma[],wma[],b1[],b2[];

//----

int ExtCountedBars=0;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init() {

if (price1!=PRICE_OPEN) price1shift = 1;

if (price2!=PRICE_OPEN) price2shift = 1;

int draw_begin;

string short_name;

IndicatorBuffers(6);

//---- indicator buffers mapping

SetIndexBuffer(0, b1);

SetIndexStyle(0, DRAW_LINE);

SetIndexEmptyValue(0, 0.0);

SetIndexBuffer(1, b2);

SetIndexStyle(1, DRAW_LINE);

SetIndexEmptyValue(1, 0.0);

SetIndexBuffer(2, _hma);

SetIndexEmptyValue(2, 0.0);

SetIndexBuffer(3, _wma);

SetIndexEmptyValue(3, 0.0);

SetIndexBuffer(4, hma);

SetIndexEmptyValue(4, 0.0);

SetIndexBuffer(5, wma);

SetIndexEmptyValue(5, 0.0);

IndicatorDigits(Digits);

//---- initialization done

return(0);

}

int start() {

int i, shift, countedBars=IndicatorCounted();

int maxBars=_maPeriod*2;

int period=_maPeriod;

double sqrtPeriod = MathSqrt(period*1.00);

int halfPeriod=period/2;

if(Bars<_maPeriod) return(-1);

if(countedBars == 0) countedBars = maxBars;

int limit=Bars-countedBars+maxBars;

//---- moving average

double wma1,_wma1;

double wma2,_wma2;

for(i=limit; i>=0; i--) {

_wma1 = iMA(Symbol(), 0, period, 0, MODE_LWMA, price1, i+price1shift);

_wma2 = iMA(Symbol(), 0, halfPeriod, 0, MODE_LWMA, price1, i+price1shift);

_wma[i] = 2.0*_wma2-_wma1;

wma1 = iMA(Symbol(), 0, period, 0, MODE_LWMA, price2, i+price2shift);

wma2 = iMA(Symbol(), 0, halfPeriod, 0, MODE_LWMA, price2, i+price2shift);

wma[i] = 2.0*wma2-wma1;

}

for(i=limit; i>=0; i--) {

_hma[i]=iMAOnArray(_wma, 0, sqrtPeriod, 0, MODE_LWMA, i);

hma[i]=iMAOnArray(wma, 0, sqrtPeriod, 0, MODE_LWMA, i);

b1[i]=_hma[i]+_hma[i]*deviation/100.0;

b2[i]=hma[i]-hma[i]*deviation/100.0;

}

return(0);

}

Comments