//+------------------------------------------------------------------+

//| EMAPredictive3.mq4 |

//| Matthew ("Dr Chaos") Kennel |

//| ftp://lyapunov.ucsd.edu/pub/nonlinear |

//+------------------------------------------------------------------+

//

// Goal of this indicator:

//

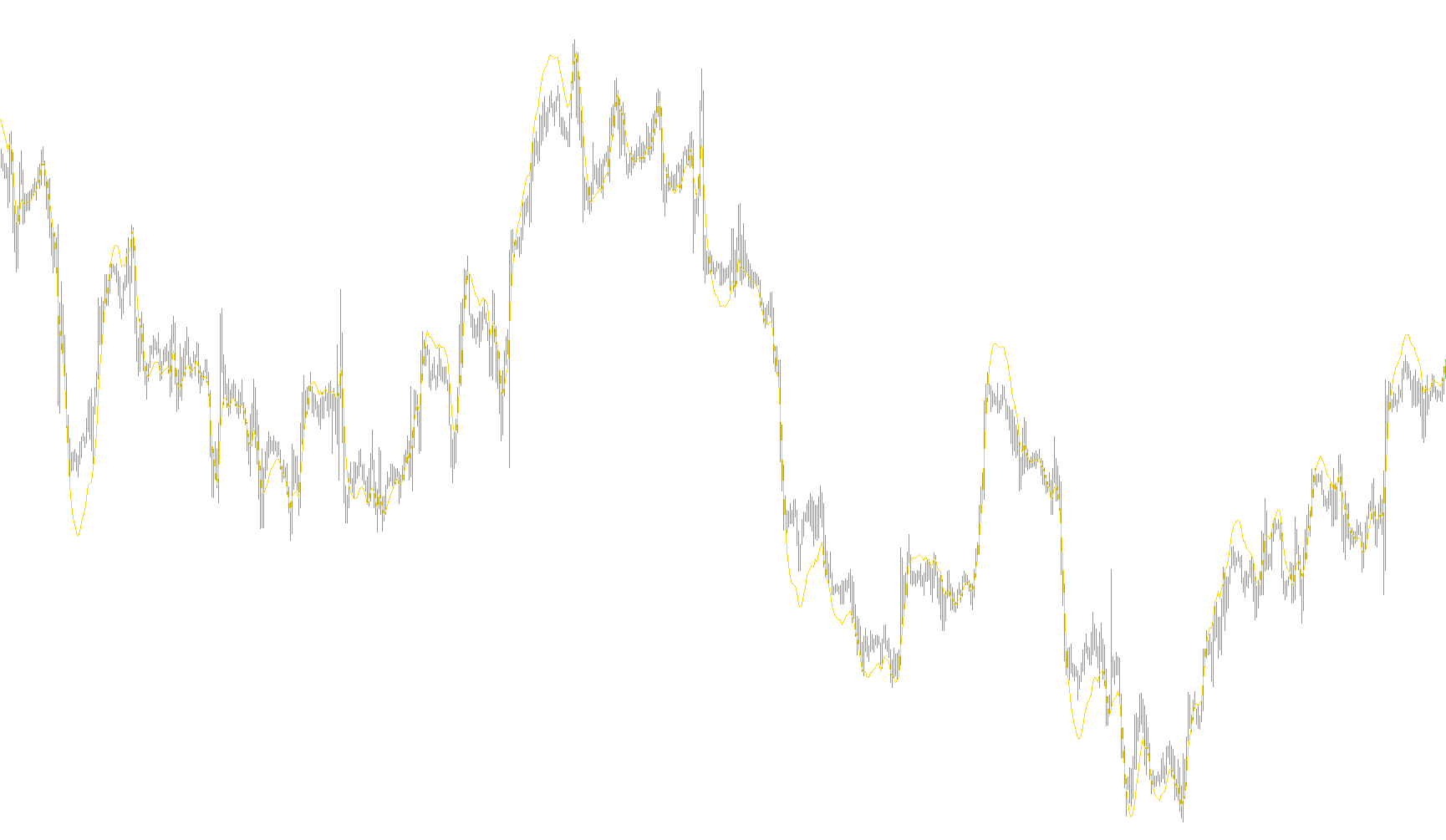

// Given three EMA's of varying lengths, use their values

// for a estimator of "where we are now" or will be in the near future.

// This is a very simplistic method, better ones are probably found

// in the signal processing and target tracking literature.

// A Kalman filter has been known since the 1950's 1960's and there

// is better still. Nevertheless this is easily programmable in the

// typical environments of a retail trading application like Metatrader4.

//

// Method:

//

// An an exponential moving average (EMA) or a simple moving average (SMA), for that

// matter, have a bandwidth parameter 'L', the effective length of the window. This

// is in units of time or, really, inverse of frequency. Higher L means a lower

// frequency effect.

//

// With a parameter L, the weighted time index of the EMA and SMA is (L-1)/2. Example:

// take an SMA of the previous 5 values: -5 -4 -3 -2 -1 now. The average "amount of time"

// back in the past of the data which go in to the SMA is hence -3, or (L-1)/2. Same applies

// for an EMA. The standard parameterization makes this correspondence between EMA

// and SMA.

//

// Therefore the idea here is to take two different EMA's, a longer, and

// a shorter of lengths L1 and L2 (L2 <L1). Now take the pairs:

// [ -(L1-1)/2, EMA(L1) ] [ -(L2-1)/2, EMA(L2) ] which defines a line.

//

//

// Extrapolate to [ExtraTimeForward, y], solve for y and that is the predictive EMA estimate.

//

// Application:

// Traditional moving averages, as simple-minded linear filters, have significant group delay.

// In engineering that isn't so important as nobody cares if your sound from your iPod is delayed

// a few milliseconds after it is first processed. But in markets, you can't

// trade on the smoothed price, only the actual noisy, market price now. Hence you

// ought to estimate better.

//

// This statistic (what math/science people call what technical analysts call an 'indicator')

// may be useful as the "fast" moving average in a moving average crossover trading system.

// It could also be useful for the slow moving average as well.

//

// For instance, on a 5 minute chart:

//

// try for the fast: (will be very wiggly, note)

//

// LongPeriod 25.0

// ShortPeriod 8.0

// ExtraTimeForward 1.0

//

// and for the slow:

//

// LongPeriod 500.0

// ShortPeriod 50.0 to 200.0

// ExtraTimeForward 0.0

//

// But often a regular MA for the slow can work as well or better, it appears from visual inspection.

//

// Enjoy.

//

// In chaos there is order, and in that order there is chaos and order inside again.

//

// Then, surrounding everything, pointy haired bosses.

//

#property copyright "Matthew (Dr Chaos) Kennel"

#property link "ftp://lyapunov.ucsd.edu/pub/nonlinear" // my academic software site. No finance.

#property indicator_chart_window

#property indicator_buffers 1

#property indicator_color1 Red

//---- input parameters

extern double LongPeriod=25.0; // note that for an EMA you can have floating point numbers.

extern double ShortPeriod=8.0;

extern double ExtraTimeForward=1.0; // how much to further extrapolate location.

//---- buffers

//---- indicator buffers

double ExtBuffer[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

SetIndexBuffer(0,ExtBuffer);

//---- drawing settings

SetIndexStyle(0,DRAW_LINE);

//---- initialization done

return(0);

}

int start()

{

int limit;

int counted_bars=IndicatorCounted();

double ma1,ma3;

double p1,p3;

double t1,t3,t;

//---- check for possible errors

if(counted_bars<0) return(-1);

//---- last counted bar will be recounted

if(counted_bars>0) counted_bars--;

limit=Bars-counted_bars;

//---- main loop

p1 = 2.0/(LongPeriod+1.0);

p3 = 2.0/(ShortPeriod+1.0);

t1 = (LongPeriod-1.0)/2.0;

t3 = (ShortPeriod-1.0)/2.0;

t = ShortPeriod + ExtraTimeForward;

ma1 = Close[limit-1];

ma3 = ma1;

for(int i=limit-1; i>= 0; i--) {

//---- ma_shift set to 0 because SetIndexShift called abowe

double val = Close[i];

double slope1, predict;

ma1 = p1*val + (1.0-p1)*ma1;

ma3 = p3*val + (1.0-p3)*ma3;

slope1 = (ma3-ma1)/(t1-t3);

predict = ma3 + slope1*t;

ExtBuffer[i]=predict;

}

//---- done

return(0);

}

//+------------------------------------------------------------------+

Comments