//+------------------------------------------------------------------+

//| Average Day Range v1.0.mq4 |

//| Copyright © 2006, Ogeima |

//| ph_bresson@yahoo.com |

//+------------------------------------------------------------------+

//Please find some notes at the end of the script

#property copyright "Copyright © 2006, Ogeima"

#property link "ph_bresson@yahoo.com"

#property indicator_separate_window

#property indicator_buffers 1

#property indicator_color1 Brown

#property indicator_minimum 0

double ADR[];

int cur_day;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

IndicatorShortName("Average Day Range " + Symbol() + " ");

IndicatorBuffers(1);

SetIndexBuffer(0,ADR);

SetIndexStyle(0,DRAW_LINE,EMPTY,3,Brown);

SetIndexEmptyValue(0,EMPTY_VALUE);

SetIndexLabel(0,"ADR " + Symbol() + " " + Period());

/*

cur_day = TimeDayOfWeek(Time[0]);

ADR[0] = AvgDayRange(1);

*/

cur_day = 6;

}

//+------------------------------------------------------------------+

//| Custom indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

int nth_day,shift;

int counted_bars = IndicatorCounted();

if(counted_bars<0) counted_bars=0;

if(counted_bars>0) counted_bars--;

int limit = Bars-counted_bars - 21;

for( shift=0 ; shift < limit; shift++ )

{

if(cur_day != TimeDayOfWeek(Time[shift])) //New Day: compute the ADR

{

cur_day = TimeDayOfWeek(Time[shift]);

nth_day ++;

ADR[shift] = AvgDayRange(nth_day);

} //if(cur_day != TimeDayOfWeek(Time[shift]))

else ADR[shift] = ADR[shift-1]; //Not a new day

} //for(shift=limit ; shift >= 0 ; shift--)

return(0);

}

//+---------------------------------------------------------------------------+

double AvgDayRange(int nth_day)

{

double R1,R5,R10,R20;

int i;

R1 = (iHigh(NULL,PERIOD_D1,nth_day)-iLow(NULL,PERIOD_D1,nth_day));

for(i=0;i<5;i++) R5 = R5 + (iHigh(NULL,PERIOD_D1,nth_day+i)-iLow(NULL,PERIOD_D1,nth_day+i));

for(i=0;i<10;i++) R10 = R10 + (iHigh(NULL,PERIOD_D1,nth_day+i)-iLow(NULL,PERIOD_D1,nth_day+i));

for(i=0;i<20;i++) R20 = R20 + (iHigh(NULL,PERIOD_D1,nth_day+i)-iLow(NULL,PERIOD_D1,nth_day+i));

R5 = R5/5;

R10 = R10/10;

R20 = R20/20;

return((R1+R5+R10+R20)/4);

}

//+---------------------------------------------------------------------------+

/*

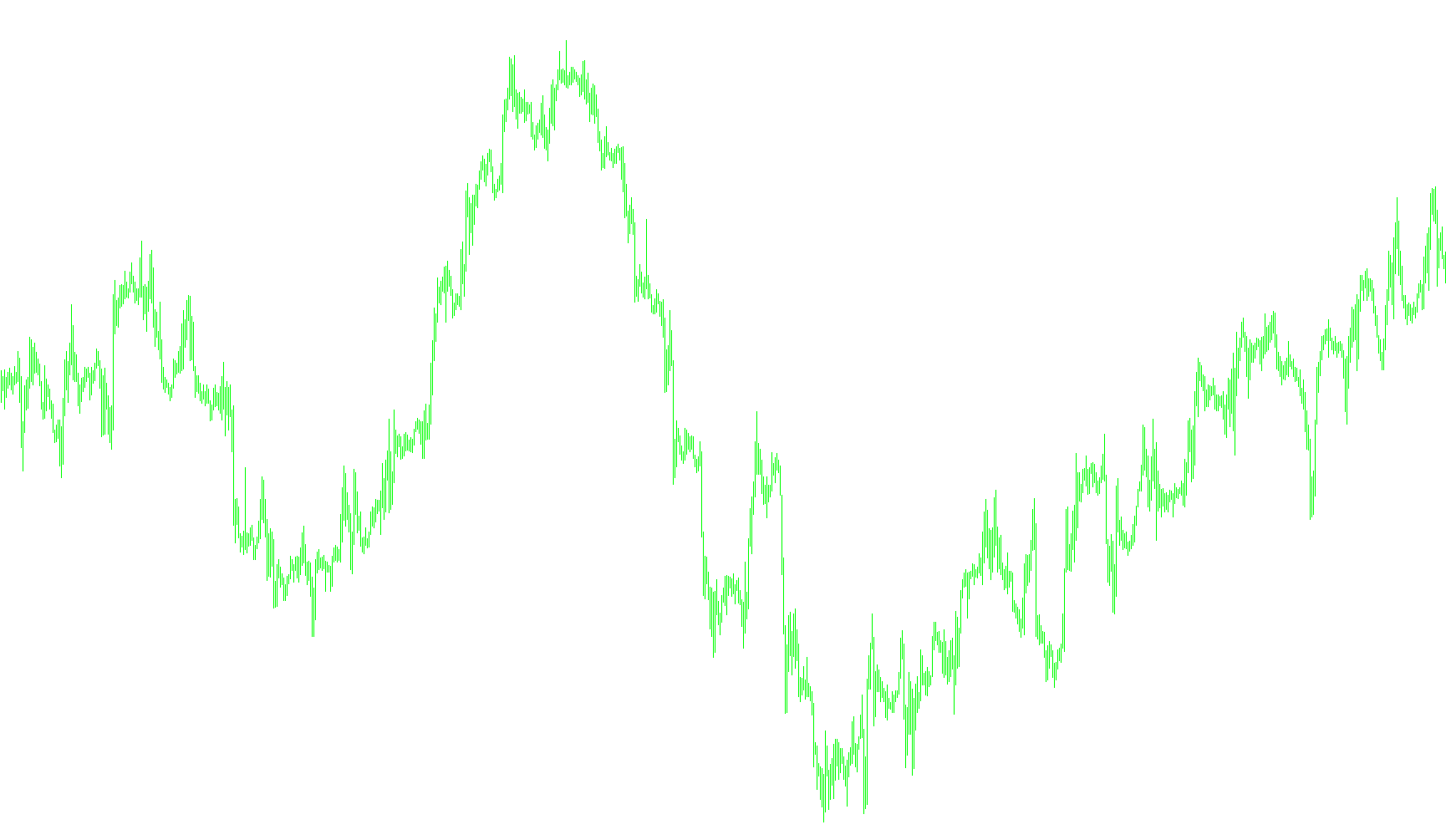

It computes yesterday's range (range= high - low), the previous 5, 10 and 20 days ranges. And it calculates the "Average Day Range" of these four ranges (yesterday's+ Prev 5 Day Range + Prev 10 Day Range + Prev 20 Day Range)/4.

So, if yesterday's Day Range was 80, the Previous 5 Day Range was 110, the Previous 10 Day Range was 90 and the Previous 20 Day Range was 120, then the Average Day Range would be 100.

ADR is therefore a kind of weighted Day Range.

For FXIGOR's DBO system, Divide_Factor is 2.

For more information regarding the DBO system, read the "FXiGoR-(T_S_R) very effective Trend Slope Retracement system" thread opened by iGoR at StrategyBuilderfx or Forex-tsd.

For FXIGOR's TSR method, use Divide_Factor = 1.

For more information regarding the T_S_R method, read the "FXiGoR-(T_S_R) very effective Trend Slope Retracement system" thread opened by iGoR at StrategyBuilderfx or Forex-tsd.

Ogeima.

*/

Comments