//+------------------------------------------------------------------+

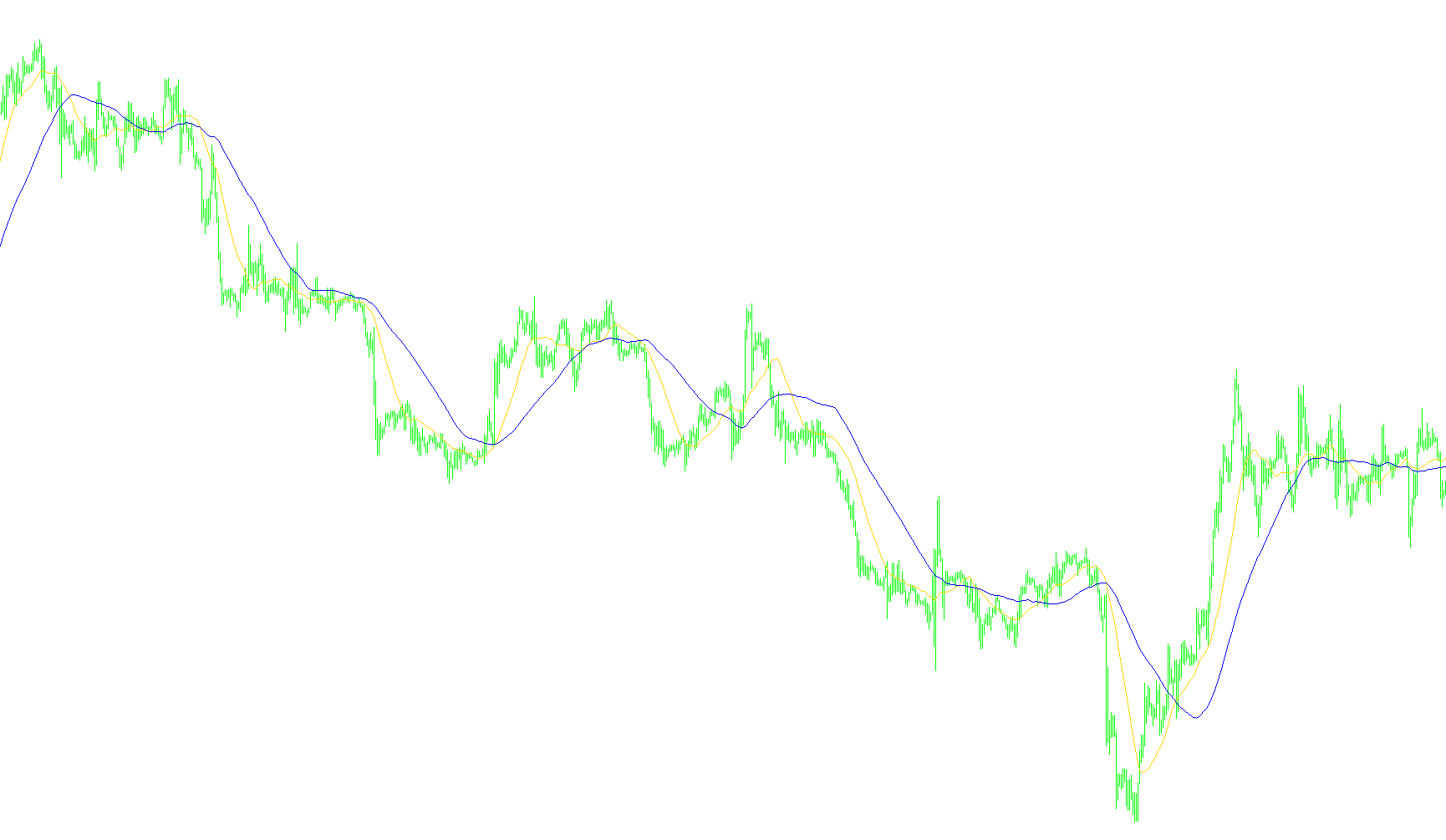

//| 4Hour Vegas Model - 4 Hour Chart MA lines |

//| Spiggy |

//| |

//| Versiom History: |

//| 02.08.2005 V0.2b - Corrected Exit Calculation to use Fibs |

//| calculated from current SMA, not entry price|

//| 09.08.2005 V0.3 - Corrected Exit P&L Calculation, updated |

//| alerts to show P&L before exit |

//+------------------------------------------------------------------+

#property copyright "Spiggy"

#property link "ian.sparkes@gmail.com"

#property indicator_chart_window

#property indicator_buffers 4

#property indicator_color1 Aqua

#property indicator_color2 Blue

#property indicator_color3 Red

#property indicator_color4 Green

//---- input parameters

extern bool Alerts=true;

extern bool PrintTags=True;

extern bool LogTrades=False;

extern int MA1=55;

extern int MA2=8;

//---- buffers

double ExtMapBuffer1[];

double ExtMapBuffer2[];

double ExtMapBuffer3[];

double ExtMapBuffer4[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

SetIndexStyle(0,DRAW_LINE);

SetIndexBuffer(0,ExtMapBuffer1);

SetIndexStyle(1,DRAW_LINE);

SetIndexBuffer(1,ExtMapBuffer2);

SetIndexStyle(2,DRAW_ARROW);

SetIndexArrow(2,1);

SetIndexBuffer(2,ExtMapBuffer3);

SetIndexStyle(3,DRAW_ARROW);

SetIndexArrow(3,2);

SetIndexBuffer(3,ExtMapBuffer4);

return(0);

}

//+------------------------------------------------------------------+

//| Custor indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

int limit;

int counted_bars=IndicatorCounted();

double SMA55;

double SMA55Prev;

double SMA8;

double SMA8Prev;

string ValueIndex;

string Direction;

bool BuyPrimed;

bool SellPrimed;

bool Bought1;

bool Bought2;

bool Bought3;

bool Sold1;

bool Sold2;

bool Sold3;

double BoughtAt;

double SoldAt;

int TagCount;

string TagName;

int i;

int j;

double RangeLimit;

bool InTrade=False;

int PandL=0;

bool FullTrade;

int LastTagOffsetAbove;

int CumulativeTagOffsetAbove;

int LastTagOffsetBelow;

int CumulativeTagOffsetBelow;

int LotsRemaining;

double SMA8Interpolated;

// Count all bars every time (bad for performance, but good for testing)

if (PrintTags)

{

limit=Bars;

}

else

{

if(counted_bars<0) return(-1);

if(counted_bars>0) counted_bars--;

limit=Bars-counted_bars;

}

// Clean up for redraw

ObjectsDeleteAll(0);

TagCount=0;

LastTagOffsetAbove = limit - 10;

LastTagOffsetBelow = limit - 10;

//---- main loop

for(i=limit-1; i>=0; i--)

{

//---- ma_shift set to 0 because SetIndexShift called abowe

SMA55=iMA(NULL,0,MA1,0,MODE_SMA,PRICE_MEDIAN,i);

SMA8 =iMA(NULL,0,MA2,0,MODE_SMA,PRICE_CLOSE,i);

SMA55Prev=iMA(NULL,0,MA1,1,MODE_SMA,PRICE_MEDIAN,i);

SMA8Prev =iMA(NULL,0,MA2,1,MODE_SMA,PRICE_CLOSE,i);

ExtMapBuffer1[i] = SMA8;

ExtMapBuffer2[i] = SMA55;

ExtMapBuffer3[i] = 0;

ExtMapBuffer4[i] = 0;

Direction = "----";

ValueIndex = TimeToStr(Time[i]-(TimeDayOfWeek(Time[i])*86400),TIME_DATE);

if ( GlobalVariableGet(Symbol() + "-ThisWeekDirection-" + ValueIndex) > 0.0 )

{

Direction = "UP ";

}

if ( GlobalVariableGet(Symbol() + "-ThisWeekDirection-" + ValueIndex) < 0.0 )

{

Direction = "DOWN";

}

if (!InTrade)

{

// ------------- TRADE ENTRY --------------

// Check the MA8/55 Crossovers

if ( Direction == "DOWN" )

{

// Check the SMA8 SM55 Crossover and prime the Sell signal

if (( SMA8 > SMA55 ) && (SMA8Prev < SMA55Prev))

{

SellPrimed = True;

BuyPrimed = False;

}

// Trigger the sell signal

if ( SMA8 < SMA8Prev )

{

if (SellPrimed)

{

// We are opening a primed trade, do full lots

FullTrade = True;

}

else

{

// Otherwise do half lots

FullTrade = False;

}

// Find the height of the tag - this should not cover any bars

RangeLimit = High[i];

for ( j = i - 7 ; j < i + 7 ; j++)

{

if (High[j] > RangeLimit)

{

RangeLimit = High[j];

}

}

SellPrimed = False;

Sold1 = True;

Sold2 = True;

Sold3 = True;

// We have to calculate the value at which we would have triggered the signal

// This is done by finding equality of SMA8Prev and SMA8

SMA8Interpolated = SMA8Prev*8 - (Close[i+0]+Close[i+1]+Close[i+2]+Close[i+3]+Close[i+4]+Close[i+5]+Close[i+6]);

SoldAt = SMA8Interpolated;

InTrade = True;

ExtMapBuffer3[i] = SoldAt;

// Put the tag on the chart

if (PrintTags)

{

if ( (LastTagOffsetAbove - i) < 10 )

{

CumulativeTagOffsetAbove = CumulativeTagOffsetAbove + 15;

}

else

{

CumulativeTagOffsetAbove = 0;

}

LastTagOffsetAbove = i;

TagName = "Entry" + TagCount;

ObjectCreate(TagName, OBJ_TEXT, 0, Time[i], RangeLimit+(70-CumulativeTagOffsetAbove)*Point);

ObjectSetText(TagName, "SELL " + TagCount + " (" + DoubleToStr(SoldAt,4) + ")", 8, "Arial", White);

}

if ( LogTrades )

{

if ( FullTrade )

{

Print("Trade " + TagCount + " : " + Symbol() + ": SELL 100% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]));

}

else

{

Print("Trade " + TagCount + " : " + Symbol() + ": SELL 50% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]));

}

}

if (Alerts)

{

if ( i == 0 )

{

Alert("["+TimeToStr(CurTime())+"] " + Symbol() + ": Sell! Quote ("+Bid+":"+Ask+")");

}

}

}

}

if ( Direction == "UP " )

{

// Check the SMA8 SM55 Crossover and prime the Buy signal

if (( SMA8 < SMA55 ) && (SMA8Prev > SMA55Prev))

{

BuyPrimed = True;

SellPrimed = False;

}

// Trigger the Buy signal or unprime the trigger

if ( SMA8 > SMA8Prev )

{

if (BuyPrimed)

{

// We are opening a primed trade, do full lots

FullTrade = True;

}

else

{

// Otherwise do half lots

FullTrade = False;

}

// Find the height of the tag - this should not cover any bars

RangeLimit = Low[i];

for ( j = i - 7 ; j < i + 7 ; j++)

{

if (Low[j] < RangeLimit)

{

RangeLimit = Low[j];

}

}

BuyPrimed = False;

Bought1 = True;

Bought2 = True;

Bought3 = True;

// We have to calculate the value at which we would have triggered the signal

// This is done by finding equality of SMA8Prev and SMA8

SMA8Interpolated = SMA8Prev*8 - (Close[i+0]+Close[i+1]+Close[i+2]+Close[i+3]+Close[i+4]+Close[i+5]+Close[i+6]);

BoughtAt = SMA8Interpolated;

InTrade = True;

ExtMapBuffer4[i] = BoughtAt;

if (PrintTags)

{

if ( (LastTagOffsetBelow - i) < 10 )

{

CumulativeTagOffsetBelow = CumulativeTagOffsetBelow + 15;

}

else

{

CumulativeTagOffsetBelow = 0;

}

LastTagOffsetBelow = i;

TagName = "Entry" + TagCount;

ObjectCreate(TagName, OBJ_TEXT, 0, Time[i], RangeLimit - (70 - CumulativeTagOffsetBelow)*Point);

ObjectSetText(TagName, "BUY " + TagCount + " (" + DoubleToStr(BoughtAt,4) + ")", 8, "Arial", White);

}

if ( LogTrades )

{

if ( FullTrade )

{

Print("Trade " + TagCount + " : " + Symbol() + ": BUY 100% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]));

}

else

{

Print("Trade " + TagCount + " : " + Symbol() + ": BUY 50% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]));

}

}

if (Alerts)

{

if ( i == 0 )

{

Alert("["+TimeToStr(CurTime())+"] " + Symbol() + ": Buy! Quote ("+Bid+":"+Ask+")");

}

}

}

}

}

else

{

// ------------- TRADE EXIT --------------

if (Sold1 || Sold2 || Sold3)

{

// Trade Exit on SMA slope change

if ( SMA8 > SMA8Prev)

{

// Find how many lots there are open

LotsRemaining = 0;

if (Sold1)

{

LotsRemaining++;

}

if (Sold2)

{

LotsRemaining++;

}

if (Sold3)

{

LotsRemaining++;

}

// Find the height of the tag - this should not cover any bars

RangeLimit = Low[i];

for ( j = i - 7 ; j < i + 7 ; j++)

{

if (Low[j] < RangeLimit)

{

RangeLimit = Low[j];

}

}

if (PrintTags)

{

// Put the tag on the chart

ExtMapBuffer4[i] = Close[i];

if ( (LastTagOffsetBelow - i) < 10 )

{

CumulativeTagOffsetBelow = CumulativeTagOffsetBelow + 15;

}

else

{

CumulativeTagOffsetBelow = 0;

}

LastTagOffsetBelow = i;

TagName = "Exit" + TagCount;

ObjectCreate(TagName, OBJ_TEXT, 0, Time[i], RangeLimit-(70-CumulativeTagOffsetBelow)*Point );

ObjectSetText(TagName, "EXIT " + TagCount + " (" + LotsRemaining + " Lots for " + DoubleToStr((SoldAt-Close[i])/Point,0) + ")", 8, "Arial", White);

}

if ( LogTrades )

{

if ( FullTrade )

{

Print("Trade " + TagCount + " : " + Symbol() + ": EXIT 100% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((SoldAt-Close[i])/Point,0) + ")");

}

else

{

Print("Trade " + TagCount + " : " + Symbol() + ": EXIT 50% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((SoldAt-Close[i])/Point,0) + ")");

}

}

if (Alerts)

{

if ( i == 0 )

{

Alert("["+TimeToStr(CurTime())+"] " + Symbol() + ": Exit Shorts! PandL ("+DoubleToStr((SoldAt-Close[i])/Point,0)+")");

}

}

if ( FullTrade )

{

PandL = PandL + ((SoldAt-Close[i])/Point)*LotsRemaining;

}

else

{

PandL = PandL + ((((SoldAt-Close[i])/Point)*LotsRemaining)/2);

}

Sold1 = False;

Sold2 = False;

Sold3 = False;

InTrade = False;

TagCount++;

}

// Exit on Fib 1

if (Sold1)

{

if( Low[i] < (SMA55 - 144*Point))

{

// Find the height of the tag - this should not cover any bars

RangeLimit = Low[i];

for ( j = i - 7 ; j < i + 7 ; j++)

{

if (Low[j] < RangeLimit)

{

RangeLimit = Low[j];

}

}

ExtMapBuffer4[i] = Close[i];

if (PrintTags)

{

if ( (LastTagOffsetBelow - i) < 10 )

{

CumulativeTagOffsetBelow = CumulativeTagOffsetBelow + 15;

}

else

{

CumulativeTagOffsetBelow = 0;

}

LastTagOffsetBelow = i;

TagName = "ExitFib1" + TagCount;

ObjectCreate(TagName, OBJ_TEXT, 0, Time[i], RangeLimit-(70-CumulativeTagOffsetBelow)*Point);

ObjectSetText(TagName, "EXIT1 " + TagCount + " (Fib1 " + DoubleToStr((SoldAt-Close[i])/Point,0) + ")", 8, "Arial", White);

}

Sold1 = False;

if ( LogTrades )

{

if ( FullTrade )

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB1 100% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((SoldAt-Close[i])/Point,0) + ")");

}

else

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB1 50% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((SoldAt-Close[i])/Point,0) + ")");

}

}

if (Alerts)

{

if ( i == 0 )

{

Alert("["+TimeToStr(CurTime())+"] " + Symbol() + ": Exit Short Fib1! PandL ("+DoubleToStr((SoldAt-Close[i])/Point,0)+")");

}

}

if ( FullTrade )

{

PandL = PandL + ((SoldAt-Close[i])/Point);

}

else

{

PandL = PandL + ((SoldAt-Close[i])/Point)/2;

}

}

}

// Exit on Fib 2

if (Sold2)

{

if ( Low[i] < (SMA55 - 233*Point))

{

// Find the height of the tag - this should not cover any bars

RangeLimit = Low[i];

for ( j = i - 7 ; j < i + 7 ; j++)

{

if (Low[j] < RangeLimit)

{

RangeLimit = Low[j];

}

}

ExtMapBuffer4[i] = Close[i];

if (PrintTags)

{

if ( (LastTagOffsetBelow - i) < 10 )

{

CumulativeTagOffsetBelow = CumulativeTagOffsetBelow + 15;

}

else

{

CumulativeTagOffsetBelow = 0;

}

LastTagOffsetBelow = i;

TagName = "ExitFib2" + TagCount;

ObjectCreate(TagName, OBJ_TEXT, 0, Time[i], RangeLimit-(70-CumulativeTagOffsetBelow)*Point);

ObjectSetText(TagName, "EXIT2 " + TagCount + " (Fib2 " + DoubleToStr((SoldAt-Close[i])/Point,0) + ")", 8, "Arial", White);

}

Sold2 = False;

if ( LogTrades )

{

if ( FullTrade )

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB2 100% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((SoldAt-Close[i])/Point,0) + ")");

}

else

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB2 50% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((SoldAt-Close[i])/Point,0) + ")");

}

}

if (Alerts)

{

if ( i == 0 )

{

Alert("["+TimeToStr(CurTime())+"] " + Symbol() + ": Exit Short Fib2! PandL ("+DoubleToStr((SoldAt-Close[i])/Point,0)+")");

}

}

if ( FullTrade )

{

PandL = PandL + ((SoldAt-Close[i])/Point);

}

else

{

PandL = PandL + ((SoldAt-Close[i])/Point)/2;

}

}

}

// Exit on Fib 3

if (Sold3)

{

if ( Low[i] < (SMA55 - 377*Point))

{

// Find the height of the tag - this should not cover any bars

RangeLimit = Low[i];

for ( j = i - 7 ; j < i + 7 ; j++)

{

if (Low[j] < RangeLimit)

{

RangeLimit = Low[j];

}

}

ExtMapBuffer4[i] = Close[i];

if (PrintTags)

{

if ( (LastTagOffsetBelow - i) < 10 )

{

CumulativeTagOffsetBelow = CumulativeTagOffsetBelow + 15;

}

else

{

CumulativeTagOffsetBelow = 0;

}

LastTagOffsetBelow = i;

TagName = "ExitFib3" + TagCount;

ObjectCreate(TagName, OBJ_TEXT, 0, Time[i], RangeLimit-(70-CumulativeTagOffsetBelow)*Point);

ObjectSetText(TagName, "EXIT3 " + TagCount + " (Fib3 " + DoubleToStr((SoldAt-Close[i])/Point,0) + ")", 8, "Arial", White);

}

// We are now out of the trade

Sold3 = False;

InTrade=False;

if ( LogTrades )

{

if ( FullTrade )

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB3 100% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((SoldAt-Close[i])/Point,0) + ")");

}

else

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB3 50% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((SoldAt-Close[i])/Point,0) + ")");

}

}

if (Alerts)

{

if ( i == 0 )

{

Alert("["+TimeToStr(CurTime())+"] " + Symbol() + ": Exit Short Fib3! PandL ("+DoubleToStr((SoldAt-Close[i])/Point,0)+")");

}

}

if ( FullTrade )

{

PandL = PandL + ((SoldAt-Close[i])/Point);

}

else

{

PandL = PandL + ((SoldAt-Close[i])/Point)/2;

}

}

}

}

if (Bought1 || Bought2 || Bought3)

{

// Trade Exit on SMA slope change

if ( SMA8 < SMA8Prev)

{

// Find how many lots there are open

LotsRemaining = 0;

if (Bought1)

{

LotsRemaining++;

}

if (Bought2)

{

LotsRemaining++;

}

if (Bought3)

{

LotsRemaining++;

}

// Find the height of the tag - this should not cover any bars

RangeLimit = High[i];

for ( j = i - 7 ; j < i + 7 ; j++)

{

if (High[j] > RangeLimit)

{

RangeLimit = High[j];

}

}

// Put the tag on the chart

ExtMapBuffer3[i] = Close[i];

if (Alerts)

{

if ( i == 0 )

{

Alert("["+TimeToStr(CurTime())+"] " + Symbol() + ": Exit Longs! PandL ("+DoubleToStr((Close[i]-BoughtAt)/Point,0)+")");

}

}

if (PrintTags)

{

if ( (LastTagOffsetAbove - i) < 10 )

{

CumulativeTagOffsetAbove = CumulativeTagOffsetAbove + 15;

}

else

{

CumulativeTagOffsetAbove = 0;

}

LastTagOffsetAbove = i;

TagName = "Exit" + TagCount;

ObjectCreate(TagName, OBJ_TEXT, 0, Time[i], RangeLimit+(70-CumulativeTagOffsetAbove)*Point );

ObjectSetText(TagName, "EXIT " + TagCount + " (" + LotsRemaining + " Lots for " + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")", 8, "Arial", White);

}

if ( LogTrades )

{

if ( FullTrade )

{

Print("Trade " + TagCount + " : " + Symbol() + ": EXIT 100% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")");

}

else

{

Print("Trade " + TagCount + " : " + Symbol() + ": EXIT 50% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")");

}

}

if ( FullTrade )

{

PandL = PandL + ((Close[i]-BoughtAt)/Point)*LotsRemaining;

}

else

{

PandL = PandL + (((Close[i]-BoughtAt)/Point)*LotsRemaining)/2;

}

Bought1 = False;

Bought2 = False;

Bought3 = False;

InTrade = False;

TagCount++;

}

// Exit on Fib 1

if (Bought1)

{

if ( High[i] > (SMA55 + 144*Point))

{

// Find the height of the tag - this should not cover any bars

RangeLimit = High[i];

for ( j = i - 7 ; j < i + 7 ; j++)

{

if (High[j] > RangeLimit)

{

RangeLimit = High[j];

}

}

ExtMapBuffer3[i] = Close[i];

if (PrintTags)

{

if ( (LastTagOffsetAbove - i) < 10 )

{

CumulativeTagOffsetAbove = CumulativeTagOffsetAbove + 15;

}

else

{

CumulativeTagOffsetAbove = 0;

}

LastTagOffsetAbove = i;

TagName = "ExitFib1" + TagCount;

ObjectCreate(TagName, OBJ_TEXT, 0, Time[i], RangeLimit+(70-CumulativeTagOffsetAbove)*Point );

ObjectSetText(TagName, "EXIT1 " + TagCount + " (Fib1 " + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")", 8, "Arial", White);

}

Bought1 = False;

if ( LogTrades )

{

if ( FullTrade )

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB3 100% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")");

}

else

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB3 50% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")");

}

}

if (Alerts)

{

if ( i == 0 )

{

Alert("["+TimeToStr(CurTime())+"] " + Symbol() + ": Exit Long Fib1! PandL ("+DoubleToStr((Close[i]-BoughtAt)/Point,0)+")");

}

}

if ( FullTrade )

{

PandL = PandL + ((BoughtAt-Close[i])/Point);

}

else

{

PandL = PandL + ((BoughtAt-Close[i])/Point)/2;

}

}

}

// Exit on Fib 2

if (Bought2)

{

if ( High[i] > (SMA55 + 233*Point))

{

// Find the height of the tag - this should not cover any bars

RangeLimit = High[i];

for ( j = i - 7 ; j < i + 7 ; j++)

{

if (High[j] > RangeLimit)

{

RangeLimit = High[j];

}

}

ExtMapBuffer3[i] = Close[i];

if (PrintTags)

{

if ( (LastTagOffsetAbove - i) < 10 )

{

CumulativeTagOffsetAbove = CumulativeTagOffsetAbove + 15;

}

else

{

CumulativeTagOffsetAbove = 0;

}

LastTagOffsetAbove = i;

TagName = "ExitFib2" + TagCount;

ObjectCreate(TagName, OBJ_TEXT, 0, Time[i], RangeLimit+(70-CumulativeTagOffsetAbove)*Point );

ObjectSetText(TagName, "EXIT2 " + TagCount + " (Fib2 " + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")", 8, "Arial", White);

}

Bought2 = False;

if ( LogTrades )

{

if ( FullTrade )

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB3 100% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")");

}

else

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB3 50% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")");

}

}

if (Alerts)

{

if ( i == 0 )

{

Alert("["+TimeToStr(CurTime())+"] " + Symbol() + ": Exit Long Fib2! PandL ("+DoubleToStr((Close[i]-BoughtAt)/Point,0)+")");

}

}

if ( FullTrade )

{

PandL = PandL + ((BoughtAt-Close[i])/Point);

}

else

{

PandL = PandL + ((BoughtAt-Close[i])/Point)/2;

}

}

}

// Exit on Fib 3

if (Bought3)

{

if ( High[i] > (SMA55 + 377*Point))

{

// Find the height of the tag - this should not cover any bars

RangeLimit = Low[i];

for ( j = i - 7 ; j < i + 7 ; j++)

{

if (Low[j] < RangeLimit)

{

RangeLimit = Low[j];

}

}

ExtMapBuffer3[i] = Close[i];

if (PrintTags)

{

if ( (LastTagOffsetAbove - i) < 10 )

{

CumulativeTagOffsetAbove = CumulativeTagOffsetAbove + 15;

}

else

{

CumulativeTagOffsetAbove = 0;

}

LastTagOffsetAbove = i;

TagName = "ExitFib3" + TagCount;

ObjectCreate(TagName, OBJ_TEXT, 0, Time[i], RangeLimit+(70-CumulativeTagOffsetAbove)*Point );

ObjectSetText(TagName, "EXIT3 " + TagCount + " (Fib3 " + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")", 8, "Arial", White);

}

// We are now out of the trade

Bought3 = False;

InTrade=False;

if ( LogTrades )

{

if ( FullTrade )

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB3 100% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")");

}

else

{

Print("Trade " + TagCount + " : " + Symbol() + ": FIB3 50% " + DoubleToStr(Close[i],4) + " at " + TimeToStr(Time[i]) + " (" + DoubleToStr((Close[i]-BoughtAt)/Point,0) + ")");

}

}

if (Alerts)

{

if ( i == 0 )

{

Alert("["+TimeToStr(CurTime())+"] " + Symbol() + ": Exit Long Fib3! PandL ("+DoubleToStr((Close[i]-BoughtAt)/Point,0)+")");

}

}

if ( FullTrade )

{

PandL = PandL + ((BoughtAt-Close[i])/Point);

}

else

{

PandL = PandL + ((BoughtAt-Close[i])/Point)/2;

}

}

}

}

}

}

Comment("Direction for W/B " + ValueIndex + ": " + Direction + ":(" + GlobalVariableGet(Symbol() + "-ThisWeekDirection-" + ValueIndex) + ")\nP&L: " + PandL);

return(0);

}

//+------------------------------------------------------------------+

Comments